Management Plan

New Medium-Term Management Plan: VISION 2025

JVCKENWOOD Corporation announced on April 27, 2023 that it has formulated a new medium-term management plan "VISION 2025," starting from fiscal 2023.

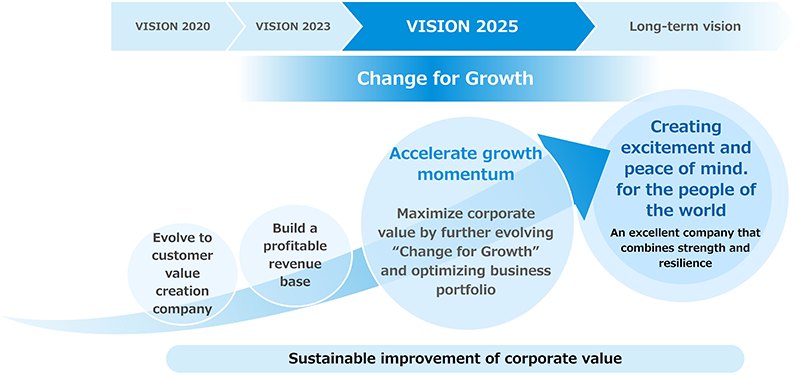

In light of the achievement of key management indicators (KPIs) of the previous medium-term management plan "VISION 2023" ahead of schedule and significant changes in the business environment surrounding the Company, such as a review of the supply chain due to increased geopolitical risks and uncertainty in global economic trends, the Company is strengthening the basic strategy of the previous medium-term management plan "VISION 2023" from the perspective of maximizing corporate value, "Change for Growth".

Positioning

In "VISION 2025," the basic strategy of "Change for Growth" set forth in "VISION 2023" will be further evolved, and the Company aims to accelerate growth momentum and maximize corporate value by optimizing its business portfolio.

Basic strategy

Under "VISION 2025," JVCKENWOOD will optimize its business portfolio and capital allocation based on the basic strategy of "Change for Growth," while promoting sustainability management to maximize corporate value. Through these initiatives, the Company will build a structure that ensures a stable ROE of 10% and aim to achieve a PBR of more than 1.0 as soon as possible.

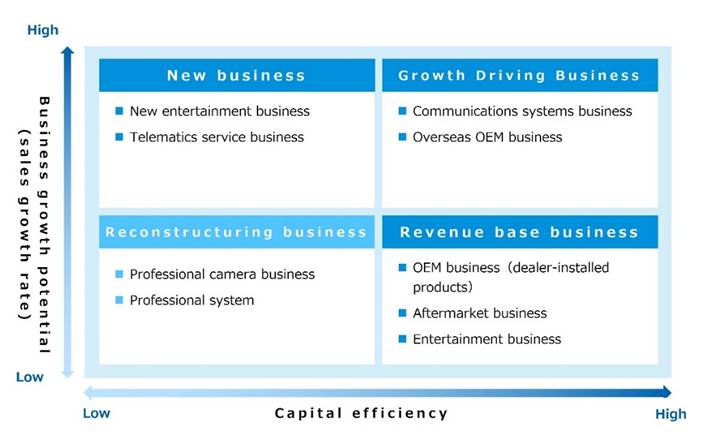

Optimize business portfolio to maximize corporate value

Under "VISION 2025," from the perspective of maximizing corporate value, JVCKENWOOD will allocate resources in consideration of medium-term business growth potential* and the Company's capital efficiency. It will also further strive to make an optimal business portfolio transformation toward fiscal 2025, thereby working to sustainably increase corporate and shareholder value.

*Sales growth rate for the three-year period from FY2023 to FY2025.

Course of action for strategy enhancement

In light of changes in the business environment surrounding the Company and from the perspective of maximizing corporate value, JVCKENWOOD reviewed the course of action for strategy enhancement in "VISION 2025" from "VISION 2023." As a result, it changed the names of business sectors to clarify the business strategies that the Company should pursue.

| Business sector | Course of action for strategy enhancement |

|---|---|

| Mobility & Telematics Services | Business expansion centered on in-vehicle speakers, amplifiers, antennas, cables, and lenses in response to market changes |

| Safety & Security | Maximize profits with the Communications Systems Business as a growth driver, mainly in North America |

| Entertainment Solutions | Strengthen game and animation business Existing Media Business to promote qualitative transformation of business |

"VISION 2025" management indicators

The management indicators under "VISION 2025" are as follows.

| FY2022 actual results | FY2023 earnings forecast (released on April 27, 2023) |

FY2025 targets | |

|---|---|---|---|

| Revenue | 336.9 billion yen | 350 billion yen | 370 billion yen or more |

| Core operating income*1 margin | 4.7% | 4.2% | 5.0% or more |

| EBITDA margin | 12.5% | 10.3% | 10% or more |

| Operating cash flow | 26.6 billion yen | 32.5 billion yen | 90 billion yen or more Cumulative total for 3 years from FY2023 to FY2025 |

| ROE | 18.2% | 8.0% | 10% or more |

| ROIC*2 | 8.3% | 7.6% | 9% or more |

*1: Core operating income is calculated by deducting cost of sales, selling and general administrative expenses from revenue, and does not include other income, other expenses, and foreign exchange gains and losses, which are primarily due to one-time factors.

*2: ROIC = (after-tax core operating income + equity-method profit or loss) / invested capital (shareholders' equity + interest-bearing debt)

Financial strategy

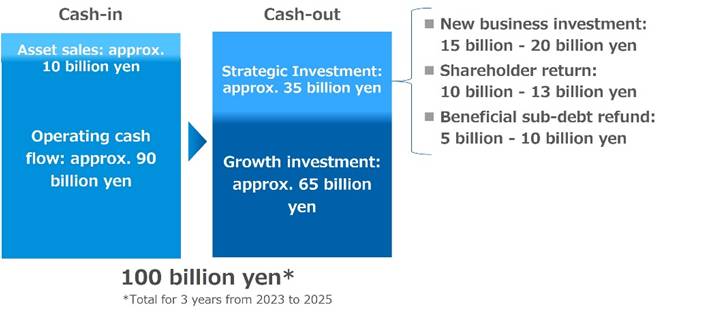

Under "VISION 2025," JVCKENWOOD aims to maximize corporate value by improving capital efficiency with an emphasis on cost of capital and executing a balanced capital allocation for growth investments.

Financial targets for FY2025

- ROE: 10% or more

- ROIC: 9% or more

- Interest-bearing debt to equity ratio (D/E ratio): 0.6 or less

- Ratio of equity attributable to owners of the parent company: 35% or more

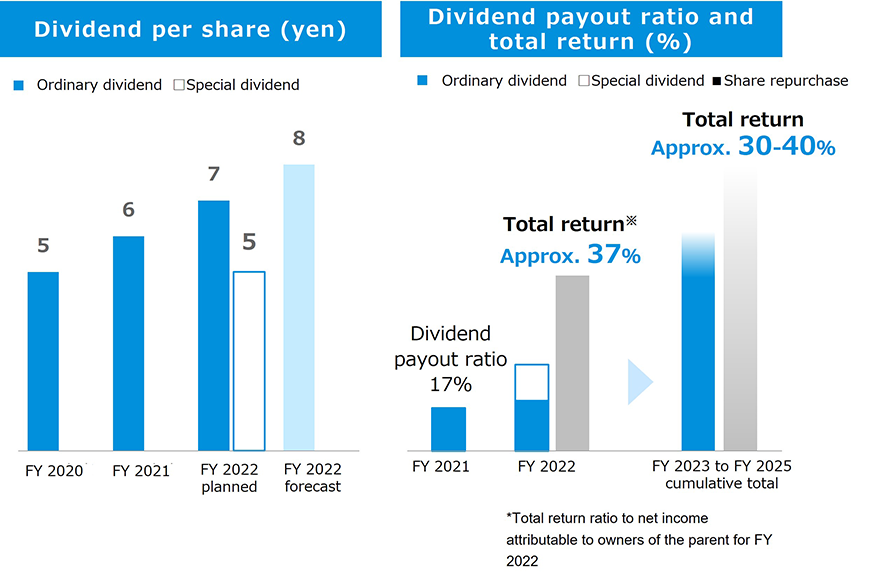

- Total payout ratio: Approximately 30-40%

Capital allocation approach

Under "VISION 2025," JVCKENWOOD will optimize capital allocation by clarifying the use of growth investments and strategic investments, with a focus on generating operating cash flow to enable profit growth in order to achieve a return on capital in excess of cost of capital.

JVCKENWOOD will strategically allocate capital by incorporating capital expenditures and investments to strengthen the management base into its growth investments, and by incorporating investments in new businesses, shareholder returns, and repayment of interest-bearing debt into its strategic investments.

Shareholders return policy

JVCKENWOOD considers the stable distribution of profits to shareholders and the securing of management resources for future growth to be one of its most important management issues. Accordingly, it has set the total payout ratio as an indicator of shareholder return, taking into consideration its overall profitability and financial condition. In addition to dividends based on business performance, the Company will flexibly repurchase treasury stock, taking into account the balance between the use of capital for medium- to long-term profit growth and the effects of improving capital efficiency, and will provide stable profit returns to shareholders with a target total payout ratio of 30-40%.

Sustainability strategy

Based on the corporate philosophy of "Creating excitement and peace of mind for the people of the world," JVCKENWOOD believes it is important to meet the expectations of all stakeholders through its business. Continuing to be a company that is trusted by and contributes to society will also lead to sustainable growth as a company.

Under "VISION 2025," the Company aims to enhance its corporate value by further deepening its activities to promote sustainability management based on "profitable growth" and "solving social issues on a global scale."

Course of action for sustainability strategy

| E: Environmental initiatives | Contribute to realizing a sustainable society by working to reduce environmental impact |

|---|---|

| S: Social initiatives | Develop human resources and strengthen organizational capacity to realize innovation and promote sustainable procurement |

| G: Governance | A promotion system to ensure sustainability management Ongoing efforts to evaluate the effectiveness of the Board of Directors for sustainable enhancement of corporate value |

*For details, please refer to the following documents.