Compliance

Basic Concept and Promotion System

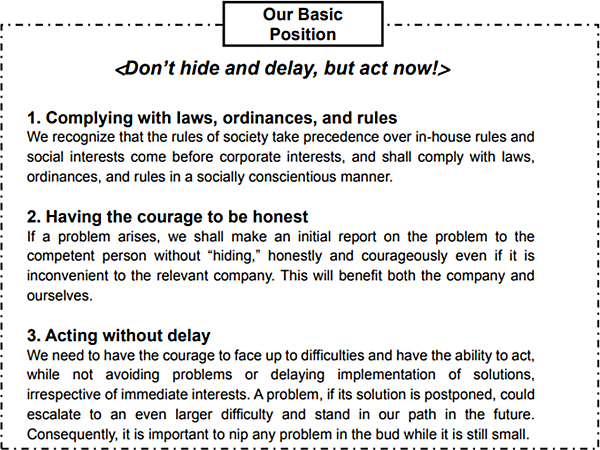

As society's values have changed, damage to corporate value is now more likely to be caused by actions that go against the demands of society, rather than legal violations. The JVCKENWOOD Group is striving to not only observe compliance laws but also consider the appropriate response to demands from society and strengthen its efforts to do so.

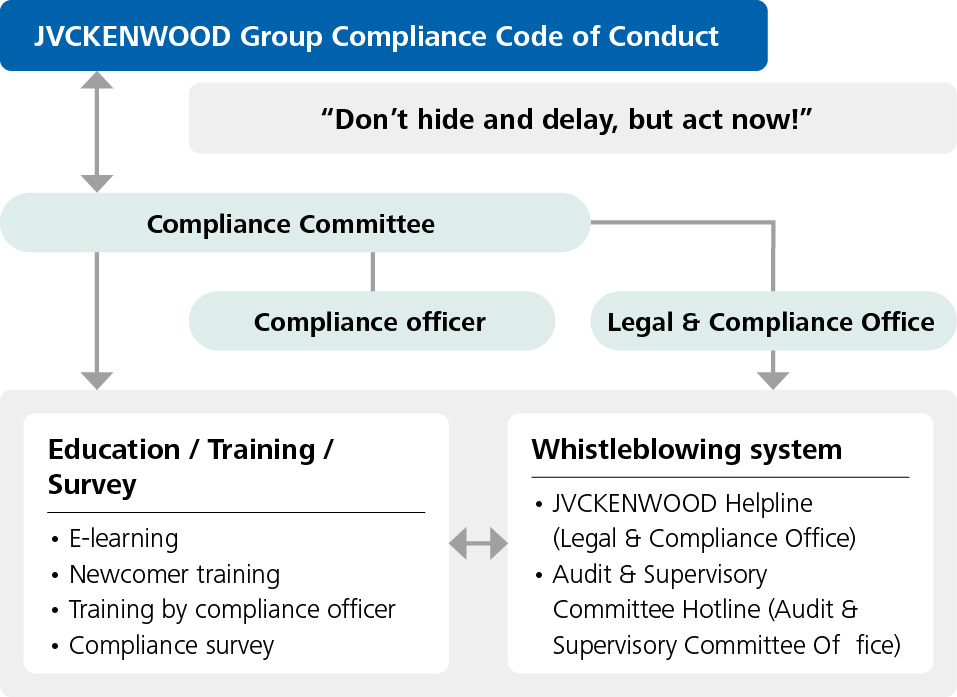

Working from this basic concept, the JVCKENWOOD Group Compliance Code of Conduct, which was formulated by the Compliance Committee — headed by the CEO — and the Legal & Compliance Office, applies to all directors and employees and spreads awareness of our basic position "Don't hide and delay, but act now!" In the event of violations of corporate ethics and other such violations of our code of conduct, we will promptly take measures to prevent recurrence.

Compliance Code of Conduct

The JVCKENWOOD Group Compliance Code of Conduct (established in March 2010) has been promulgated among all executives and employees within the Group through pamphlets (available in three languages) and an Intranet site. Employees at affiliate companies under the Group’s purview are being familiarized with the Standards by Compliance Officers selected by the Board of Directors.

The Internal Governance Group under the Legal & Compliance Office check the status of compliance with the JVCKENWOOD Group Compliance Code of Conduct from time to time, reporting the results to the Board of Directors every fiscal year, and respond to inquiries from employees and others.

Specific Initiatives to Promote Compliance

Comply with Compliance Code of Conduct

The JVCKENWOOD Group has established a system for monitoring the compliance status of the entire Group's Compliance Code of Conduct through the Compliance Committee and the Internal Governance Group under the Legal & Compliance Office, and annually reviews the effectiveness of all compliance activities - including the Code of Conduct - based on the status of revisions to relevant laws and regulations.

To prevent compliance violations, we have installed a whistleblowing system and conducted compliance training to foster awareness of compliance throughout the Group. Deviation from the Compliance Code of Conduct, corruption, violations of legislation and corporate ethics are reported through the whistleblowing system. In the event that a report of a compliance violation is made to one of the whistle-blowing systems, or if a concern about such a violation arises, the whistle-blowing system contact and the relevant department will confirm the facts of the report. If the report is found to be a compliance problem, the Compliance Committee will examine the details closely, take appropriate corrective measures according to the content of the violation. Corrective measures are reported to the whistleblower, the name of the person concerned is not disclosed, and only the content is disseminated within the company to prevent the recurrence of similar cases. In FY2024, there were three reported cases of legal and compliance violations, and all cases were discussed and dealt with strictly by the Compliance Committee, following consultation, discussion, etc., with external experts as necessary. In addition, we not only dealt with the persons involved, but also took measures such as various forms of training, monitoring with awareness surveys, etc., and sharing information on our intranet, distributing an e-mail newsletter, and displaying posters to raise internal awareness of contact points. We have enhanced awareness of fraud risk through company-wide enlightenment measures, and are taking steps to prevent recurrence.

Reporting System

■Employee reporting contact point

The JVCKENWOOD Group has two whistleblower systems (a JVCKENWOOD Helpline (“Helpline”) established in the Legal & Compliance Office and an Audit and Supervisory Committee Hotline established in the Audit & Supervisory Committee Office) for use by all executives and employees

(including contract employees) anonymously. The Helpline consists telephone helpline and an online reporting system, operated by an external whistleblowing service company, which acts as a third-party contact. (services are available in Japanese, English, Chinese and Korean)

Any concerns about corporate ethics in general and compliance, such as human rights violations, harassment, and all forms of corruption (embezzlement, bribery, etc.) are directly reported to the Helpline based on Internal Reporting Rules, and corrective measures will be taken under the leadership of the Compliance Committee. Misconduct by officers is reported directly to the Audit and Supervisory Committee Hotline and appropriate action is taken. Both systems employ a dedicated communications system run by selected personnel to protect the whistleblower’s name and maintain the confidentiality of the report. We will continue using both systems to detect and rectify compliance violations (behaviors that deviate from social norms) as early as possible.

■Reporting contact point for external stakeholders

At the JVCKENWOOD Group, we accept reports concerning violations of laws, regulations, and company rules, etc., at the Company from external stakeholders via the complaint and reporting contact point provided by the Japan Center for Engagement and Remedy on Business and Human Rights (JaCER).*

Reporters can submit anonymous reports to the complaint and reporting contact point provided by the Japan Center for Engagement and Remedy on Business and Human Rights (JaCER), in which we participate as a full member. After receiving a report, we take measures to rectify issues and prevent recurrence, based on proposals for a response and support from JaCER.

* The Japan Center for Engagement and Remedy on Business and Human Rights (JaCER) is an organization that provides the non-judicial "Engagement and Remedy Platform" for redress of grievances based on the "United Nations Guiding Principles on Business and Human Rights," through which it aims to support and promote the processing of complaints by member companies from a specialist standpoint.

We will continue using both systems to detect and rectify compliance violations (behaviors that deviate from social norms) as early as possible.

Compliance Training

Education on compliance is principally the responsibility of the Internal Governance Office under the Legal & Compliance Office, which endeavors under the CEO’s guidance to thoroughly inform all executives and employees including those of 27 overseas group companies on compliance matters in order to construct a robust compliance structure. Based on the Compliance Code of Conduct, compliance training is provided to all employees (including contract and dispatched employees). New employees are provided with training in face-to-face sessions, while other employees are provided with regular training through e-learning. In the survey in FY2024, around 3,250 officers and employees responded to the survey.

Compliance Officers conduct annual training for division heads under their direct supervision and other executives. The training is on the topics covered by the Compliance Activity Standards and other related regulations as well as on the prohibition against facilitation payments and bribery of foreign officials, prevention of corruption, such as giving or accepting excessive gifts, unfair competition, corporate scandals and the whistleblower system. Approximately 5,800 executives and employees took part in compliance training during FY2024.

Enhancement of Compliance Awareness and Survey on Instillation Within the Company

With a view to further enhancing compliance awareness, we have been distributing compliance related e-mails to all officers and employees once a month since FY2018, and posting and updating compliance-related content on our intranet. The newsletter also includes compliances news and easy-to-understand explanations of compliance violations that have occurred around the world. It also features columns and case studies to raise awareness of the importance of compliance. Furthermore, in order to understand how well awareness of compliance has been embedded in the Company, we have been implementing an annual survey of Group company officers and employees in Japan during e-learning since 2017. For the survey implemented in FY2024, approximately 3,250 officers and employees responded.

Anti-Corruption Initiatives

Under the supervision of the Board of Directors, the JVCKENWOOD Group clearly states in the JVCKENWOOD Group Compliance Code of Conduct and its internal rules that it prohibits all forms of bribery and corruption and that no illegal or inappropriate means should be employed that may be used to influence the actions of others. In addition to adherence to laws and regulations related to the prevention of corruption, we also prohibit corruption, including bribery and embezzlement, such as the exploitation of company property and the possessions of others, and the utilization of one's duties to demand benefits such as the inappropriate receipt of money, goods, or other benefits.

In relation to corruption such as the above, we assess corruption risk at the JVCKENWOOD Group and business partners.

Every year, we conduct risk surveillance across all divisions to assess corruption risk at the JVCKENWOOD Group. In risk surveillance, we check whether there have been any acts such as inappropriate entertainment and gifts, then we revise internal regulations and strengthen corruption prevention initiatives based on the results.

In the JVCKENWOOD CSR Procurement Guidelines, which summarize the rules that the Group expects business partners to adhere to, we set forth matters related to the prevention of corruption at business partners. We regularly spread awareness at partners meetings, and also assess corruption risk at existing business partners through responses to self-assessment sheets (SAQs).

When entering into contracts with new business partners, in order to eliminate antisocial forces, we clearly state that the contract will be canceled if it is discovered that the counterparty is an antisocial force or has any links to antisocial forces. We also focus on preventing bribery and other forms of corruption, including checking whether business partners have created systems for compliance with laws and regulations and whether they have ever violated laws and regulations on application forms for new business partners.

To prevent corruption such as bribery and facilitation payments, we conduct compliance training, e-learning, and information dissemination via the intranet to raise awareness of anti-corruption measures.

The Compliance Committee looks into major incidents of noncompliance, such as bribery and corruption, and discusses measures to prevent their recurrence. All incidents of misconduct, including bribery and corruption, are reported to the Board of Directors. There were no legal actions related to corruption taken against us in 2024.

We also place importance on ensuring transparency of our corporate activities, and will continue to disclose information, including donations to specific political parties and organizations (political donations made in FY2024: 0 yen).

Anti-Harassment Initiatives

Since June 2020, the "Labor Measures Comprehensive Promotion Act" (Act on Comprehensive Promotion of Labor Measures, Stabilization of Employment of Employees and Enrichment of Their Working Lives, etc.) has been enforced. In order to raise awareness within the company, we conduct harassment training for employees and disseminate information via the intranet.

The Audit and Supervisory Committee's Commitment on Compliance

At JVCKENWOOD, the Audit and Supervisory Committee is responsible for the management audit function, including the detection of fraud, evaluation of internal controls, and monitoring legal compliance. The term of office of Audit and Supervisory Committee members is stipulated as two years by the Companies Act, and they are periodically rotated when their terms of office expire. Audit and Supervisory Committee members conduct fair and impartial audits from an independent standpoint.

Internal Audits

With regard to internal audits in the Company, the Internal Audit Office conducts internal audits of the execution of business operations and internal control evaluations related to financial reporting (J-SOX evaluations) for the JVCKENWOOD Group as a whole, in accordance with audit plans based on the approval of the Board of Directors, and the results are reported to the Board of Directors as a supervisory body. In the Internal Audit Office, 13 people are currently engaged in internal audits and J-SOX evaluations.

The Internal Audit Office conducts on-site and remote audits of the Company and a wide-range of JVCKENWOOD Group affiliates, and performs centralized monitoring of the status of internal controls, which facilitates risk-based and objective assessments of matters such as the effectiveness and efficiency of corporate governance systems, compliance, other internal control systems and the status of their implementation, and business activities. The Internal Audit Office also provides information and useful recommendations for improvement based on the results of such assessments, thereby contributing to ensuring and maintaining social reliability across the JVCKENWOOD Group as a whole.

Accounting Audits

Selection and Assessment of Accounting Firm

The Company has assessed the audit firm that is the current Accounting Auditor of the Company with respect to matters such as its understanding of the JVCKENWOOD Group, identification of risk domains and response, quality management systems, independence, policies for formulating audit plans and details thereof, status of group audits including network firms, response to fraud risk, and appropriateness of audit compensation, and it has judged that it meets the necessary standard as the audit firm of the Company, which faces risks related to changes in the business environment, etc., and various other risks.

The Company has also established the "Policy on Determining Dismissal or Refusal of Reappointment of the Accounting Auditor" as follows.

"If the Accounting Auditor falls under any of the circumstances set forth in each item of Article 340, paragraph (1) of the Companies Act, the Audit and Supervisory Committee shall dismiss the Accounting Auditor with the consent of all Audit and Supervisory Committee members. In addition, in principle, if circumstances arise that will significantly hinder the audit operations of the Company, such as the Accounting Auditor receiving an audit operation suspension disposition from the supervisory government agency, the Audit and Supervisory Committee shall determine the content of a proposal related to the dismissal or non-reappointment of the Accounting Auditor to be submitted at a Shareholders' Meeting."

The Audit and Supervisory Committee perform assessments every year, in accordance with the "Criteria for Evaluation of Appointment and Dismissal of Accounting Auditor" established by the Audit and Supervisory Committee, and consider the necessity of selecting or dismissing the audit firm based on these assessments and the aforementioned "Policy on Determining Dismissal or Refusal of Reappointment of the Accounting Auditor." As a result of an assessment of the eligibility of the current audit firm based on these criteria and consideration based on the "Policy on Determining Dismissal or Refusal of Reappointment of the Accounting Auditor," the Audit & Supervisory Board has judged that there are no problems and the reappointment of the current audit firm is appropriate.

Regular Rotation of Accounting Auditor by Audit Firm and Re-Participation

In accordance with rules concerning audit firms based on the Certified Public Accountants Act and other laws and regulations, the JVCKENWOOD Group confirms that the audit firm is regularly rotating the engagement partners responsible for accounting audits, as follows.

- In principle, engagement partners and the lead engagement partner may not participate in audit operations at the Company beyond seven and five continuous accounting periods, respectively.

- In principle, engagement partners and the lead engagement partner may not participate again in audit operations at the Company for two and five accounting periods after they are replaced, respectively.

Tax Governance

JVCKENWOOD Group Tax Policy (June 2024)

The JVCKENWOOD Group shares its philosophy of "Creating excitement and peace of mind for the people of the world" as the fundamental belief of the corporate behavior. Based on this shared philosophy, we are committed to achieving sustainable growth and medium- to long-term improvement of corporate value by ensuring high levels of profitability and fulfilling our corporate social responsibility. We believe this is achieved through compliance with laws, regulations, corporate policies, social customs, and sound corporate ethics.

1. Basic Policy on Tax

The JVCKENWOOD Group is committed to making correct tax payments by complying with the tax laws of each country and other tax guidelines published by international organizations such as the Organization for Economic Co-operation and Development (OECD). In addition, we do not undertake the application of preferential tax treatment based on any interpretations which deviate from the legislative intent of laws and regulations. We do not intentionally undertake the avoidance of taxes in a manner entailing the absence of substance in terms of businesses, nor do we undertake any tax planning of an abusive nature which deploys the usage of tax havens.

2. Tax Governance

The JVCKENWOOD Group's tax governance is governed by the Company's director in charge of finance. The Company's department in charge of taxes undertakes the processing, reviewing, reporting, and managing of tax-related matters. With this structure in place, we also incorporate the opinions of external experts for matters which involve higher levels of expertise. In order to raise awareness of tax compliance at the Group companies, we are committed to promoting in-house training and awareness-building activities concerning appropriate accounting and tax processing, as well as the promoting efforts to establish systems for tax consultations to take place.

3. Tax Planning

The JVCKENWOOD Group actively leverages the tax breaks available in each country to maximize shareholder value in the context of business activities undertaken by the Group across the globe. However, as stated in the basic policy, we do not engage in tax avoidance activities which deviate from the laws and regulations established in each country. Furthermore, with a full understanding of the taxation approaches in the tax systems, such as the Global Anti-Base Erosion Rules (GloBE), international rules regarding global minimum taxation that is set to be enforced in the future, we will ensure that we file appropriate tax returns and make tax payments accordingly when such approaches are applicable.

4. Tax Risk Reduction and Monitoring

Through regular monitoring, exchange of information, and various reporting on the state of execution of tax-related matters of Group companies, we gain an understanding of the tax risks involved, make corrections as necessary, and provide operational support. We also strive to ascertain risks in advance and are working to reduce tax risks by taking measures before risks emerge, by having advice provided by external experts, by undertaking confirmations with tax authorities, and by undertaking other such efforts.

AI Governance

The JVCKENWOOD Group, amid the rapid development and increasing social impact of AI technology, formulated an AI ethics policy in May 2022 based on the JVCKENWOOD Group Compliance Code of Conduct as part of its human rights initiatives.AI Policy consists of compliance with laws and international norms, respect for human rights, ensuring safety, transparency and accountability, AI development and human resource development, and dialogue with stakeholders. This policy applies to all executives and employees who use AI or conduct research and development, and reflects their stance in their business activities. The Group will also actively encourage all external partners in our value chain, including business partners and suppliers that we may influence through our business, to comply with this Policy and to take appropriate action.

Further, we have established the AI Use and Application Secretariat and are strengthening the governance necessary for minimizing the ethical risks related to AI. As part of our in-house initiatives, we have opened an internal AI school that carries out drills with the aim of organizing AI ethics training, enhancing AI literacy, ensuring an appropriate response to and consistency with domestic and international AI regulation trends similar to the AI laws in the European Union, and further encouraging the use and application of AI. We have also developed a system that supports daily management and operations, as well as incident response, and will continue to strengthen our AI governance system while fully utilizing AI technology.