Corporate Governance

Basic Concept and Initiatives

The JVCKENWOOD Group regards increasing the transparency and efficiency of decision-making in management by strengthening corporate governance and aiming to improve corporate value as one of the most important management issues. The JVCKENWOOD Corporate Governance Policy is basic policy on corporate governance touching upon the each of the principles of the Corporate Governance Code, and it serves as guidelines for implementing a sound and robust governance system throughout the Group.

JVCKENWOOD Corporate Governance Policy

(established December 1, 2015, revised June25, 2025)

The JVCKENWOOD Group is undertaking company-wide efforts to bolster corporate governance and continually generate profit in order to meet the expectations of our stakeholders and to achieve our Corporate Philosophy of “Creating excitement and peace of mind for the people of the world.”

In promoting our initiatives, we set the following KPI (Key Performance Indicators) and manage their progress.

The themes of our initiatives are enhancement of deliberations at meetings of the Board of Directors, establishing medium- to long-term Board succession, holding Director training, off-site meetings, etc., revising the directors' compensation system, and stronger diversity in the Board of Directors and senior management.

As part of our efforts to further improve the effectiveness of the Board of Directors, regarding enhancement of deliberations at meetings of the Board of Directors, establishing medium- to long-term Board succession, holding Director training, off-site meetings, etc., and revising the directors' compensation system, we have set multiple KPIs aimed at ensuring more substantial deliberations at meetings of the Board of Directors.

Regarding "stronger diversity in the Board of Directors and senior management," we believe that ensuring diversity in the Board of Directors and senior management will result in the reflection of diverse values in management strategy and thus contribute to sustainable growth amid increasingly fierce global competition. Accordingly, we aim to ensure that women make up at least 30% of all directors by FY2030.

The Company appointed two female External Directors, and one female Executive Officer, on June 25, 2025.

| Theme | KPI | ||||

|---|---|---|---|---|---|

| Plan/Achievement | FY2023 | FY2024 | FY2025 | FY2030 | |

|

Plan |

|

|

|

|

| Achievement | ◎ | ◎ | |||

|

Plan |

|

|

||

| Achievement | |||||

|

Plan |

|

|

|

|

| Achievement | ◎ | ◎ | |||

|

Plan |

|

|

||

| Achievement | |||||

|

Plan | Appointing one or more female executive officers* | Appointing two or more female executive officers* | Appointing three or more female executive officers* | Aim to achieve a ratio of female directors of over 30% |

| Achievement | ◎ | ◎ | |||

* Directors of the Board, Executive Officers, and other officers and employees with equivalent roles

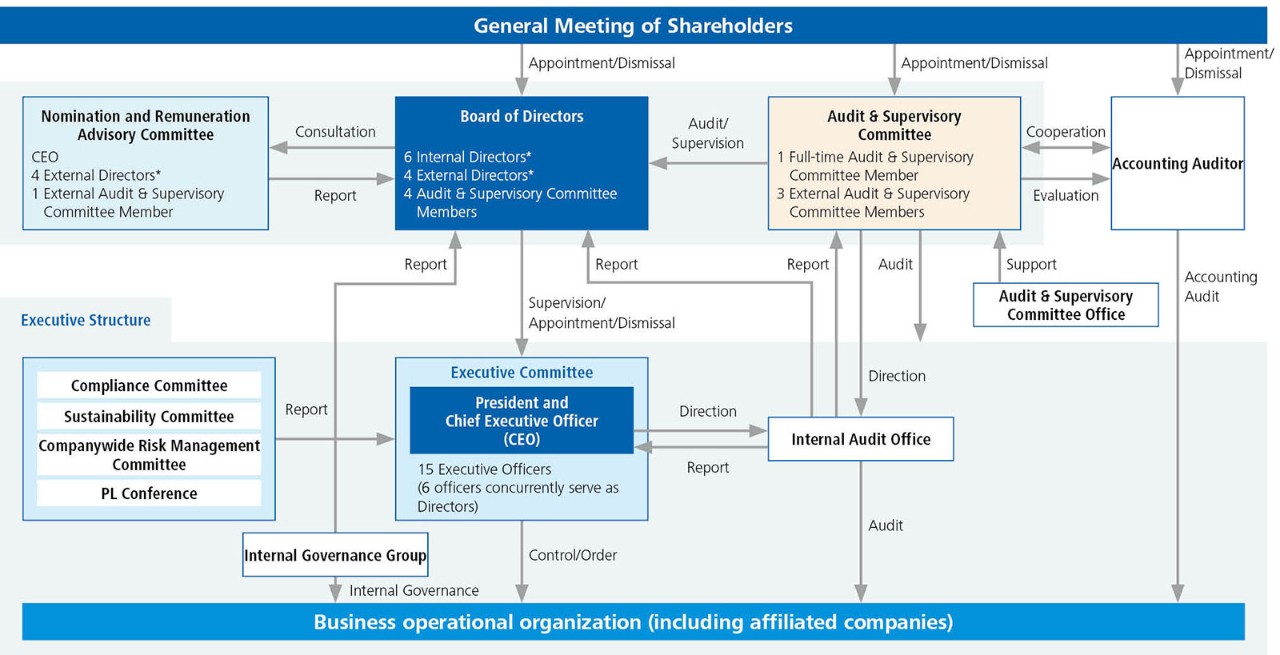

Corporate Governance Structure

We make it a basic policy to enhance our corporate governance through the establishment of a structure that calls for "the separation of management from the execution of businesses", "the appointment of External Directors and External Audit & Supervisory Board Members", and "the improvement of check functions by establishing an Internal Audit Division", thereby strengthening the Company's internal control system on a Group-wide basis.

Corporate Governance Structure (as of June 25, 2025)

Corporate Organizations

1. Reasons for adopting an executive officer system in the form of a company with an Audit and Supervisory Committee as a corporate governance system Policy for Constructive Dialogue with Shareholders

JVCKENWOOD believes that the most effective way to embody its corporate governance principles of separating management from execution, the appointment of independent external directors of the board, and strengthening checking functions by establishing an internal audit department is to introduce an executive officer system along with an audit and supervisory committee. The aim is to establish a mechanism that facilitates collaboration among internal departments. Therefore, we have established the following management structure.

2. Matters concerning the Board of Directors

The Company shall regard the Board of Directors as the fundamental and strategic decision-making body, as well as the supervisory body for business execution. The Board of Directors shall have a regular meeting once a month and an extraordinary meeting as necessary to discuss and resolve basic policies and important matters relating to management, as well as supervise and monitor the status of business execution. The term of office of Directors is one year to ensure the clarification of their responsibilities and swift management decision-making. The Board of Directors shall also actively appoint External Directors to promote highly transparent decision-making and take the initiative in corporate reform and governance.

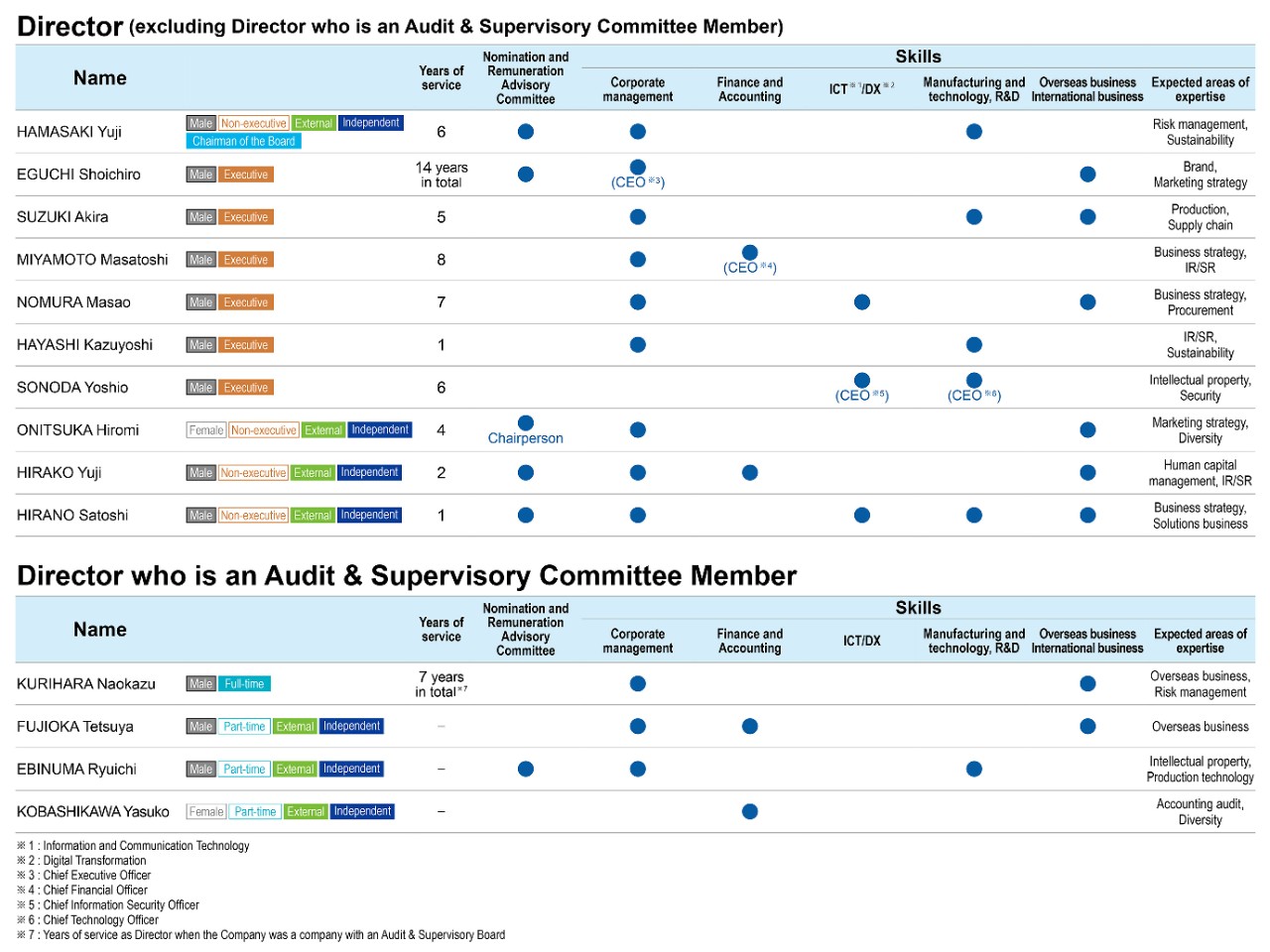

Ten Directors (Excluding Directors who are Audit & Supervisory Committee Members) — Mr.HAMASAKI Yuji (Chairman of the Board and External Director), Mr. EGUCHI Shoichiro (Representative Director of the Board), Mr. SUZUKI Akira (Representative Director of the Board), Mr. MIYAMOTO Masatoshi (Representative Director of the Board), Mr. NOMURA Masao, Mr. HAYASHI Kazuyoshi, Mr.SONODA Yoshio, Ms. ONITSUKA Hiromi (External Director), Mr. HIRAKO Yuji (External Director) and Mr. HIRANO Satoshi (External Director) — and four Directors who are Audit & Supervisory Committee Members — Mr. KURIHARA Naokazu, Mr. FUJIOKA Tetsuya (External Director), Mr. EBINUMA Ryuichi (External Director) and Ms. KOBASHIKAWA Yasuko (External Director) were elected at the 17th Ordinary General Meeting of Shareholders held on June 25, 2025.

Since June 2016, JVCKENWOOD has appointed an External Director independent from and neutral to the management of the Company as the Chairman of the Board of Directors, and established a place for active exchange of opinions and discussions at meetings of the Board of Directors. As of June 25, 2025, Mr. HAMASAKI Yuji, who serves as External Director, chairs the Board of Directors. The Chairman of the Board determines agendas for a meeting of the Board of Directors in consultation with the Chief Executive Officer (CEO) and Executive Officer in charge of Administrative Division, etc. prior to deliberations of the Board of Directors. In addition, the Chief Executive Officer (CEO) is responsible for convening meetings of the Board of Directors and preparing minutes of meetings of the Board of Directors, etc. as the Representative Director of the Board.

3. Matters concerning the Audit and Supervisory Committee

The Company has a company with audit and supervisory committee framework. Directors who are Audit & Supervisory Committee members attend important meetings and hold Audit & Supervisory Committee meetings. Their duties include collaboration with the Internal Audit Division, audits of the execution of duties by directors of the Board and the business execution of the entire Group, corporate accounting, and the corporate audit function. The Audit & Supervisory Committee holds meetings once a month, and extra meetings are held as needed.

Four Directors who are Audit & Supervisory Committee Members — Mr. KURIHARA Naokazu (Director (Full-time Audit & Supervisory Committee Member)), Mr. FUJIOKA Tetsuya (External Director), Mr. EBINUMA Ryuichi (External Director) and Ms. KOBASHIKAWA Yasuko (External Director) — were elected at the 17th Ordinary General Meeting of Shareholders held on June 25, 2025.

4. Matters concerning the Nomination and Remuneration Advisory Committee

The Company established the Nomination and Remuneration Advisory Committee, for which all of its External Directors serve as committee members, in December 2015, with the aim of strengthening the independence and objectivity of the functions of the Board of Directors. Since its establishment, the Nomination and Remuneration Advisory Committee has made proposals to the Board of Directors regarding candidate representatives for JVCKENWOOD, and reviewed the appropriateness of director candidates and directors' compensation plans proposed by the representatives and others, and reported its opinions. The Board of Directors has determined director candidates and directors' compensation, taking into consideration the opinions stated by the Nomination and Remuneration Advisory Committee.

In addition, in April 2019, the Company added the Chief Executive Officer (CEO) to committee members of the Nomination and Remuneration Advisory Committee in order for External Directors who serve as committee members to share accurate internal information in a timely manner and to improve the effectiveness of the Nomination and Remuneration Advisory Committee. The procedures for deliberating a proposal and making determination regarding candidate representatives for the Company by the Nomination and Remuneration Advisory Committee are performed by all the committee members who serve as External Directors except for the committee member who is the CEO.

As of June 25, 2025, Mr. HAMASAKI Yuji, Ms. ONITSUKA Hiromi, Mr. HIRAKO Yuji, HIRANO Satoshi and Mr. EBINUMA Ryuichi who serve as External Directors, and Mr. EGUCHI Shoichiro, who serves as CEO, serve as committee members, and Ms. ONITSUKA Hiromi chairs the Nomination and Remuneration Advisory Committee by resolution of the Nomination and Remuneration Advisory Committee as of the same date.

5. Matters concerning Executive Officer System

The Company has introduced an Executive Officer System under which the management supervisory function is separated from the business execution function to clarify management responsibility and business execution responsibility since its establishment in October 2008.

The Board of Directors, in order to lead the Company's initiatives in corporate reform and governance, is chaired by an External Director, holds discussions between External Directors as independent directors and Directors concurrently serving as Executive Officers to make highly transparent decisions, and entrusts the business execution to Executive Officers. In accordance with decisions made at meetings of the Board of Directors, CEO, serving as the Chairman, takes the lead in the Executive Officers Committee's meetings.

Each of the Executive Officers is in charge of the Mobility & Telematics Service Sector (M&T Sector), Safety & Security Sector (S&S Sector), or Entertainment Solutions Sector (ES Sector) or serves as General Executive of the Business Division in those sectors, and assumes responsibility for the overall operations of all businesses in the three regions, the Americas, EMEA (Europe, Middle East, and Africa), APAC (Asia Pacific) as the head of overseas, China as the COO, Domestic Business Marketing, Emerging Markets, or important subsidiaries and thus their responsibilities are clarified in both businesses and regions.

Furthermore, we introduced an execution system under which each Executive Officer is appointed to the positions of CFO (Chief Financial Officer) , CTO (Chief Technology Officer) , CISO(Chief Information Security Officer) or is in charge of each corporate division to support the CEO, and performs their duties.

Skill Matrix

The Company formulated a medium-term management plan, VISION 2025, in April 2023. The following is a summary of the areas of expertise and skills expected of the management team in order to solve the management issues faced by the Company and achieve medium to long-term improvements in corporate value, as well as to ensure diversity and balance on the Board of Directors.

The reasons and standards for skills are as shown below.

| Skills | Reason for selection as a skill | Standard for skill |

|---|---|---|

| Corporate management | Selected as a skill in order to adapt to the changing environment and to sustainably increase corporate value. | To hold experience in the execution of business as CEO, etc., at a business company, or to hold knowledge in corporate management based on experience in the execution of business, such as in the position of officer in charge of the Corporate Planning Department. |

| Finance and accounting | Selected as a skill in order to maximize corporate value while balancing with improved capital efficiency and growth investments, and in addition, to improve shareholder return. | To hold experience in the execution of business as in the position of officer in charge of the Finance and Accounting Department, or to hold knowledge in finance and accounting based on experience at financial institutions and accountancy firms, etc. |

| ICT/DX | Selected as a skill in order to strengthen the management foundation and to review our business portfolio in response to changes in the external environment. | To hold knowledge based on experience in ICT- or DX-related businesses or to strengthen the management foundation. |

| Manufacturing and technology, R&D | Selected as a skill for sustainable manufacturing and the creation of new value. | To hold knowledge based on experience in the execution of business, such as in the position of officer in charge of the Manufacturing, Technology, or Research and Development Department. |

| Overseas business International business | Selected as a skill for profitable growth and the solving of global social issues. | To hold knowledge based on experience in the execution of business, such as in the position of officer in charge of the Manufacturing, Technology, or Research and Development Department. |

Meeting Attendance in FY 2024

*Title as of March 31, 2025

| Board of Directors meetings | Attendance | |

|---|---|---|

| External Director of the Board | HAMASAKI Yuji (Chairman) | 15 times (100%) |

| Representative Director of the Board | EGUCHI Shoichiro | 15 times (100%) |

| Representative Director of the Board | NOMURA Masao | 15 times (100%) |

| Representative Director of the Board | MIYAMOTO Masatoshi | 14 times (93.3%) |

| Director of the Board | SUZUKI Akira | 15 times (100%) |

| Director of the Board | HAYASHI Kazuyoshi | 12 times (100%)*1 |

| Director of the Board | SONODA Yoshio | 15 times (100%) |

| External Director of the Board | ONITSUKA Hiromi | 14 times (93.3%) |

| External Director of the Board | HIRAKO Yuji | 14 times (93.3%) |

| External Director of the Board | HIRANO Satoshi | 12 times (100%)*1 |

| Fulltime Audit & Supervisory Board Member | KURIHARA Naokazu | 15 times (100%) |

| Fulltime Audit & Supervisory Board Member | FUJIOKA Tetsuya | 15 times (100%) |

| Fulltime Audit & Supervisory Board Member | EBINUMA Ryuichi | 12 times (100%)*1 |

| Fulltime Audit & Supervisory Board Member | KOBASHIKAWA Yasuko | 10 times (83.3%)*1 |

| (External Director of the Board) | IWATA Shinjiro | 3 times (100%)*2 |

| (Fulltime Audit & Supervisory Board Member) | IMAI Masaki | 3 times (100%)*2 |

| (Fulltime Audit & Supervisory Board Member) | SAITO Katsumi | 3 times (100%)*2 |

| (Fulltime Audit & Supervisory Board Member) | KURIHARA Katsumi | 3 times (100%)*2 |

| Audit & Supervisory Board Meetings | Attendance | |

| Fulltime Audit & Supervisory Board Member | KURIHARA Naokazu | 12 times (100%)*1 |

| External Audit & Supervisory Board Member | FUJIOKA Tetsuya | 15 times (100%) |

| External Audit & Supervisory Board Member | EBINUMA Ryuichi | 12 times (100%)*1 |

| External Audit & Supervisory Board Member | KOBASHIKAWA Yasuko | 10 times (83.3%)*1 |

| (Fulltime Audit & Supervisory Board Member) | IMAI Masaki | 3 times (100%)*2 |

| (External Audit & Supervisory Board Member) | SAITO Katsumi | 3 times (100%)*2 |

| (External Audit & Supervisory Board Member) | KURIHARA Katsumi | 3 times (100%)*2 |

| Nomination and Remuneration Advisory Committee meetings | Attendance | |

| External Director of the Board | ONITSUKA Hiromi (Committee chairman) | 14 times (100%) |

| External Director of the Board | HAMASAKI Yuji | 14 times (100%) |

| External Director of the Board | HIRAKO Yuji | 13 times (92.9%) |

| External Director of the Board | HIRANO Satoshi | 11 times (100%)*1 |

| Representative Director of the Board | EGUCHI Shoichiro | 14 times (100%) |

| (External Director of the Board) | IWATA Shinjiro | 3 times (100%)*2 |

| Board of Executive Officers meetings | 15 time/year | |

- *1 Attendance rates are calculated based on 12 Board of Directors meetings, 12 Audit & Supervisory Board meetings, and 11 Nomination and Remuneration Advisory Committee meetings held after their assumption of office.

- *2 Attendance rates are calculated based on 3 Board of Directors meetings, 3 Audit & Supervisory Board meetings, and 3 Nomination and Remuneration Advisory Committee meetings held until their retirement due to the expiration of his term of office.

External Officers (Criteria for Independence and Activities)

Criteria for Independence for External Officer

Article 18 of JVCKENWOOD Corporate Governance Policy

In general, to ensure the effectiveness of the supervisory function of the management based on experience, achievements, expertise, insights, and other attributes, as well as independence from conflicts of interest with general shareholders, the Company shall elect candidates for External Directors by confirming their business backgrounds and ensuring that they are not principal shareholders of the Company or have never been engaged in business execution at the Company's main business partners (with a transaction value of one percent or more of the consolidated net sales of the Company), based on its criteria and policies for independence set out in accordance with the "Guidelines for the Governance of Listed Companies" (III 5. (3)-2) established by the Tokyo Stock Exchange.

*III 5. (3)-2 of the "Guidelines concerning Listed Company Compliance, etc." (revised April 1, 2025) of the Tokyo Stock Exchange, Inc. |

||

| The status of a person(s) who is reported to Tokyo Stock Exchange, Inc. as being an independent director(s)/auditor(s) by the issuer of a listed domestic stock pursuant to the provisions of Rule 436-2 "Handling of the Securing of Independent Director(s)/Auditor(s)" of the Enforcement Rules for Securities Listing Regulations when such person falls under any of the following a. to d.; | ||

| a. | A person for which said company is a major client or a person who executes business for such person, or a major client of said company or a person who executes business for such client; | |

| b. | A consultant, accounting professional or legal professional (in the case of a group such as a corporation or association, this shall refer to a person belonging to such group) who receives a large amount of money or other asset other than remuneration for directorship/auditorship from said company; or | |

| c. | A person who has recently fallen under a. or the preceding b. | |

| c-2. | A person who has fallen under the following (a) or (b) at any time within 10 years before taking office | |

| (a) | A person who executes business for a parent company of said company (including a director who does not execute business or an auditor in cases where said company designates its outside auditor as an independent director); or | |

| (b) | A person who executes business for a fellow subsidiary of said company. | |

| d. | A close relative of a person referred to in any of the following (a) to (f) (excluding those of insignificance); | |

| (a) | A person referred to in a. to the preceding c-2.; | |

| (b) | Accounting advisor of said company (limited to cases where said company designates its outside auditor as an independent director; if such an accounting advisor is a juridical person, it shall include the employee who is to perform the duties of such an accounting advisor, the same shall apply hereinafter); | |

| (c) | )A person who executes business for a subsidiary of said company (including a director who does not execute business or an accounting advisor in cases where said company designates its outside auditor as an independent auditor); | |

| (d) | A person who executes business for a parent company of said company (including a director who does not execute business or an auditor in cases where said company designates its outside auditor as an independent director); | |

| (e) | A person who executes business for a fellow subsidiary of said company; or | |

| (f) | A person who has recently fallen under (b) or (c), or a person who executed business for said company (in cases where an outside director is designated as an independent auditor, including a director who does not execute business). | |

Major Activities of External Officers in FY2024 (from April 1, 2024 to March 31, 2025)

During the fiscal year ended March 31, 2025, there were 15 Board of Directors' meetings, 15 Audit & Supervisory Board meetings, and 14 Nomination and Remuneration Advisory Committee meetings.

| Position | Name | Major Activities |

|---|---|---|

| External Director | HAMASAKI Yuji | Chairman of the Board of Directors. Mr. HAMASAKI provides advice and propositions to secure the appropriateness and correctness of the decisions of the Board of Directors in a timely manner from the position of an independent officer who is an objective third party not involved in the business execution of the Group, as well as proper advice based on his plentiful experience, knowledge, and expert perspective in the information and communications and heavy electric machinery fields from corporate management of a listed company. He also served as a member of Nomination and Remuneration Advisory Committee. |

| ONITSUKA Hiromi | Ms. ONITSUKA provides advice and propositions to secure the appropriateness and correctness of the decisions of the Board of Directors in a timely manner from the position of an independent officer who is a third party not involved in the business execution of the Group, as well as proper advice based on her plentiful experience, knowledge, and expert perspective in the information industry sector, electric industry sector, mainly OEM sales, overseas distributor sales, and etc., from operations and corporate management of a listed company. She also served as a Chairman of Nomination and Remuneration Advisory Committee. | |

| HIRAKO Yuji | Mr. HIRAKO provides advice and propositions to secure the appropriateness and correctness of the decisions of the Board of Directors in a timely manner from the position of an independent officer who is a third party not involved in the business execution of the Group, as well as proper advice based on his plentiful experience, knowledge, and expert perspective in corporate management within Japan and overseas from operations and corporate management of a listed company. He also served as a member of Nomination and Remuneration Advisory Committee. | |

| HIRANO Satoshi | Mr. HIRANO provides advice and propositions to secure the appropriateness and correctness of the decisions of the Board of Directors in a timely manner from the position of an independent officer who is a third party not involved in the business execution of the Group, as well as proper advice based on his plentiful experience, knowledge, and expert perspective gained through his work in the manufacturing and engineering divisions of listed companies and through his management of companies in Japan and overseas as a Director He also served as a member of Nomination and Remuneration Advisory Committee. | |

| External Audit & Supervisory Board Member | FUJIOKA Tetsuya | Mr. FUJIOKA provides necessary comments regarding issues such as the agenda and discussions of the Board of Directors and Audit & Supervisory Board in a timely manner from the position of an independent officer who is an objective third party not involved in the business execution of the Group, utilizing his wealth of experience, knowledge, and professional perspective gained through his experience in the accounting and finance divisions of listed companies outside the Group and in overseas corporations, as well as his management experience as a corporate auditor. |

| EBINUMA Ryuichi | Mr. EBINUMA provides necessary comments regarding issues such as the agenda and discussions of the Board of Directors and Audit & Supervisory Board in a timely manner from the position of an independent officer who is an objective third party not involved in the business execution of the Group, making full use of his extensive experience, knowledge, and expert perspective gained from his extensive work experience in the manufacturing and engineering divisions, etc. of listed companies outside the Group as well as his management experience as a corporate auditor in the audit activities of the Group. | |

| KOBASHIKAWA Yasuko | Ms. KOBASHIKAWA provides necessary comments regarding issues such as the agenda and discussions of the Board of Directors and Audit & Supervisory Board in a timely manner from the position of an independent officer who is an objective third party not involved in the business execution of the Group, making full use of her expertise as a certified public accountant and tax accountant, and her management experience as an External Director and external Audit & Supervisory Board Member of a listed company outside our group and knowledge in overall corporate management and governance from her experience as a director of a listed company in the audit activities of the Group. |

Notes:

JVCKENWOOD Corporation held the 17th Ordinary General Meeting of Shareholders on June 25, 2025 and changed its corporate governance structure to a Company with an Audit & Supervisory Committee, effective as of the close of the meeting. In line with this change, all External Audit & Supervisory Board Members have been appointed as Directors who are Audit & Supervisory Committee Members.

Independent Officers Notification

Independent Officers Notification

Corporate Officer Remuneration

1. Total Amount of Remuneration by Corporate Officer Title, by Type of Remuneration, and Number of Officers Receiving

(From April 1, 2024 to March 31, 2025)

Corporate officer title

|

Total remuneration (Millions of yen)

|

Total remuneration by type (Millions of yen) |

Number of corporate officers eligible for remuneration

|

|||

|---|---|---|---|---|---|---|

Fixed remuneration |

Performance-based remuneration |

Retirement Benefit |

Non-monetary remuneration etc. |

|||

Directors |

304 |

266 |

37 |

― |

38 |

7 |

Audit &Supervisory Board Members &Supervisory Board Members) |

21 |

21 |

― |

― |

― |

2 |

External Corporate Officer |

78 |

78 |

― |

― |

― |

10 |

Total |

405 |

367 |

37 |

― |

38 |

19 |

*For more information, see Securities Report for the 17th Fiscal Year Ended March 2025 (April 1, 2024 - March 31, 2025) (Japanese)

2. Matters Pertaining to the Policy, etc. Concerning the Determination of the Amount of Remuneration, etc. for Directors (excluding Directors who are Audit & Supervisory Committee Members), etc. and its Calculation Method

Policy Concerning the Determination of Remuneration, etc., for Directors (excluding Directors who are Audit & Supervisory Committee Members) and Outline of Method of Determination

The Company determines remuneration, bonuses, and other economic benefits, for Directors (excluding Directors who are Audit & Supervisory Committee Members), to be received as consideration for the execution of duties ("remuneration, etc. of Directors (excluding Directors who are Audit & Supervisory Committee Members)") by resolution at a Shareholders' Meeting.

The remuneration, etc. of Directors (excluding Directors who are Audit & Supervisory Committee Members) consists of a three-tier structure, including fixed remuneration, short-term incentive (hereinafter, "STI"*1) and medium- to long-term incentive (hereinafter, "LTI"*2), each of which is clearly defined.

*1 STI: Short Term Incentive.

*2 LTI: Long Term Incentive.

The Company has set forth a method for determining the amount of remuneration based on internal rules resolved by the Board of Directors, following a report from the Nomination and Remuneration Advisory Committee, within the scope of the total amount of remuneration resolved at a Shareholders' Meeting.

Specifically, at the 17th Ordinary General Meeting of Shareholders held on June 25, 2025, a resolution was passed stipulating that in addition to the fixed remuneration, the amount of remuneration, etc., including bonuses and other monetary remuneration as the above STI, shall be no more than 432 million yen per year for Directors (excluding Directors who are Audit & Supervisory Committee Members) (including no more than 96 million yen per year for external Directors). The aforementioned total amount of remuneration for Directors (excluding Directors who are Audit & Supervisory Committee Members) also includes the portion of remuneration as an employee for Directors who work as employees at the same time (including the Executive Officer's portion), and the above stock-based payment as LTI is separate. No retirement benefits shall be paid to Directors (excluding Directors who are Audit & Supervisory Committee Members).

At the conclusion of the 17th Ordinary General Meeting of Shareholders held on June 25, 2025, there were ten (10) Directors (excluding Directors who are Audit & Supervisory Committee Members) (including four (4) External Directors).

Compensation Structure

Officer compensation consists of (1) fixed remuneration, (2) short-term incentive (STI), and (3) medium- and long-term incentive (LTI). The proportion of each type of compensation is as follows: (1) fixed remuneration = 75%, (2) short-term incentive (STI) = 10% or 15%, and (3) medium- and long-term incentive (LTI) = 15% or 10%.

Looking ahead, JVCKENWOOD will work toward increasing the proportion made up of performance-based payment as a method to strengthen incentives aiming for further growth.

Fixed Remuneration

Fixed remuneration is an amount of remuneration determined in accordance with internal rules for each title (President, Executive Vice President, Senior Managing Executive Officer, Managing Executive Officer, etc.) and each position (Representative, Chairman of the Board, Member of Nomination and Remuneration Advisory Committee, etc.), paid as monthly remuneration in cash.

STI

The Company pays as a bonus the STI that will be added to or subtracted from the calculation base amount calculated from the individual amount of base remuneration, ranging from 0% (no payment) to 200% (double the amount of the calculation base) according to business performance (profit, capital efficiency indicators, etc.) (STI is not paid to Directors who do not serve as Executive Officers at the same time).

STI for FY2024 was determined according to specific indicators linked to performance and adjustment coefficients determined at a meeting of the Board of Directors held on August 1, 2024, based on performance in FY2024. A total amount of 48 million yen was paid to six Directors serving as Executive Officers at the same time in FY2024.

A sample of the STI calculation formula is as follows.

Bonus = STI standard annual amount (Y) × comprehensive assessment (X%)

Comprehensive assessment (X%) = (a × A) + (b × B) + (c × C)]

| Assessment | |||

|---|---|---|---|

| Assessment item, proportion, and actual results | Comprehensive assessment | ||

| Assessment item 1 | Assessment item 2 | Assessment item 3 | |

| Proportion | Proportion | Proportion | X% |

| a% | b% | c% | |

| Actual results | Actual results | Actual results | |

| A% | B% | C% | |

* For assessment items 1 through 3, up to three are selected for each Executive Officer based on the attributes of the areas that they oversee

The assessment items are determined in accordance with the mission of each Executive Officer, from among the following six items: revenue, core operating income, profit, return on invested capital (ROIC), free cash flow, and year-end inventories

* Allocated such that a+b+c=100

* Comprehensive assessment X is the total result of multiplying the proportion of each assessment item by its actual result

In addition, ESG indicators (engagement, CO2 emissions reduction, and external assessment) have been added as KPIs for short-term incentive performance evaluations.

LTI

The Company introduces a stock remuneration system using trusts ("this system") as LTI for Directors of the Company (excluding Directors who are Audit & Supervisory Committee Members or External Directors).

The purpose of this system is to raise Directors' awareness of contributing to the improvement of medium- to long-term performance and the enhancement of corporate value by further clarifying the linkage between the remuneration for Directors and the value of the Company's shares, and enabling Directors to share profit and risks arising from share price fluctuation with shareholders. The Company also introduces a similar stock remuneration system for Executive Officers who do not concurrently serve as Directors. An outline of this system is as follows.

(1) Individuals eligible for the System |

|

|---|---|

(2) Applicable Period |

|

(3) Upper limit of cash contributed by the Company as funds for the acquisition of the Company's shares necessary to be delivered to the eligible individuals described in (1) during the applicable period (three fiscal years) described in (2) |

|

(4) Acquisition method of the Company's shares |

|

(5) Upper limit for the total number of points to be granted to the eligible individuals of (1) and the number of the Company's shares equivalent to this |

|

(6) Criteria for granting points |

|

(7) Timing of delivery of the Company's shares to the eligible individuals described in (i) |

|

(8) Transfer restriction period in the transfer restriction agreement |

|

Matters Related to Return of Remuneration etc.

Provisions have also been established to the effect that the Company may also acquire the shares that have been delivered without consideration in cases such as the following: the transfer, provision as collateral, or disposal of shares that have been delivered during the transfer restriction period; illegal acts; petition for the commencement of bankruptcy or civil rehabilitation proceedings; resignation for reasons that are not legitimate; material compliance violations; or defamation of the Company. In addition to the above, as a result of the voluntary acquisition of a certain amount of the Company's shares every month through the Executive Shareholding Association, Directors and Executive Officers engage in management from a shareholder's perspective that prioritizes medium- to long-term performance.

3. Matters Related to the Policy Concerning the Determination of the amount of Remuneration for Directors Who Are Audit & Supervisory Committee Members its Calculation Method

The Company determines remuneration, etc., for Directors who are Audit & Supervisory Committee Members, to be received as consideration for the execution of duties by resolution at a Shareholders' Meeting.

The 17th Ordinary General Meeting of Shareholders held on June 25, 2025, it was resolved that remuneration for Directors who are Audit & Supervisory Committee Members shall be no more than 108 million yen per year. No retirement benefits shall be paid to Directors who are Audit & Supervisory Committee Members. At the conclusion of the 17th Ordinary General Meeting of Shareholders held on June 25, 2025 there were four(4) Directors who are Audit & Supervisory Committee Members(including three (3) External Directors).

Following consultation among the Directors who are Audit & Supervisory Committee Members, the Company has set forth the specific amount of remuneration for each Director who is an Audit & Supervisory Committee Member based on internal rules, within the scope of the total amount of remuneration resolved at a Shareholders' Meeting.

Specifically, the remuneration for Directors who are Audit & Supervisory Committee Members consists of a basic remuneration and the remuneration according to each title (Audit & Supervisory Committee Member, and Chairman of the Audit & Supervisory Committee, etc.), in addition, "Audit & Supervisory Committee Member remuneration", "Chairman of the Audit & Supervisory Committee remuneration", or "Full-time Audit & Supervisory Committee Member remuneration". Audit & Supervisory Committee Members are not eligible for STI or LTI payment.

Evaluation on Effectiveness of the Board of Directors

The JVCKENWOOD Group has evaluated and analyzed the effectiveness of the Board of Directors annually since 2016 in accordance with Article 17 of the JVCKENWOOD Corporate Governance Policy. The tenth such effectiveness evaluation was carried out in January 2025, with the results of interviews with each Director and Audit & Supervisory Board Member, in addition to their self-evaluations, aggregated and analyzed by a third-party organization. The results confirmed that the Company as a whole has achieved a satisfactory level of effectiveness.

The methods and results overview of the tenth Board of Directors effectiveness evaluation were as follows.

May 14, 2025

JVCKENWOOD Corporation

EGUCHI Shoichiro

Representative Director of the Board, President,

Chief Executive Officer (CEO)

Summary of the Results of Evaluation on Effectiveness of the Board of Directors

JVCKENWOOD Corporation ("JVCKENWOOD") provides in Article 17 of the JVCKENWOOD Corporate Governance Policy, established on December 1, 2015, that "the Board of Directors shall conduct an evaluation and analysis on its effectiveness as a whole, and disclose a summary of the results." Accordingly, we evaluated and analyzed the effectiveness of the Board of Directors after January 2025.

1. Summary of the method of evaluation on effectiveness of the Board of Directors

This is the tenth year of the evaluation and we arranged interviews with each Director and Audit & Supervisory Board Member, in addition to their self-evaluations, to improve the quality of the evaluation while ensuring consistency. We analyzed and evaluated the difference from the past evaluation results by combining these individual interviews conducted by a third-party organization to receive candid opinions with data aggregation and analysis by the third-party organization to conduct evaluation while ensuring objectivity.

● Persons subject to evaluation:

Directors and Audit & Supervisory Board Members

● Evaluation method:

Persons subject to evaluation draft their answers to the "Self-Evaluation Questionnaire" and are interviewed by a third-party organization. The answers and contents of the interviews are compiled and analyzed by the third-party organization.

●Content of the Self-Evaluation Questionnaire:

Proposed evaluation items were created in light of the appropriate roles of the Board of Directors of the Company and its functional enhancement. Then the questionnaire was prepared by narrowing down the evaluation items, taking into account opinions of an outside expert, which is a third-party organization, and based on the analysis and consideration of factors, such as the internal and external environment surrounding JVCKENWOOD.

2. Summary of the results of evaluation on effectiveness of the Board of Directors

- It can be concluded that the Company's Board of Directors as a whole has achieved a satisfactory level of effectiveness.

- Strengths of the Company's Board of Directors and points of improvement compared with last year

- (1) Constructive and vigorous discussions aimed at improving corporate value in a free, equal and positive atmosphere

- (2) Readiness to continuously work sincerely on the growth of governance and the evaluation of the effectiveness of the Board of Directors, and towards the making of improvements based on the results of such evaluations

- (3) Deepening the discussion from a short-term/medium-term focus to a long-term perspective

- (4) Redefining executive training and off-site meetings

- Measures to improve the effectiveness of the Board of Directors

By changing the organizational design of the Company to a Company with an Audit & Supervisory Committee in June 2025, in addition to redefining the functions and roles of the Board of Directors and evaluating how authority is delegated, we will work toward agenda-setting and efficient meeting administration at the Board of Directors. We are also moving forward with discussions aimed at medium- to long-term board succession.

The information obtained in individual interviews during the evaluation of the effectiveness of the Board of Directors will be examined from the three perspectives of Inside Directors of the Board, Outside Directors of the Board, and Audit & Supervisory Board Members, future measures sought for the Board of Directors will be identified, and discussions on the results of this will be held at the Board of Directors; through this, it is aimed to improve the effectiveness of the Board of Directors.

[For reference: JVCKENWOOD Corporate Governance Policy]

(Evaluation of the Board of Directors)

Article 17

1. The Board of Directors shall conduct an analysis and evaluation on its effectiveness as a whole, and disclose a summary of the results.

2. In relation to the evaluation of the effectiveness of the Board of Directors, in order to elicit honest opinions and conduct an evaluation while ensuring objectivity, the Board of Directors shall employ a method involving aggregation and analysis by a third-party organization, and in addition analyze and assess changes from the previous evaluation, with regard to each Director's and Audit & Supervisory Board Member's self-evaluation.

[Supplementary Principle 4-11 (3) Information to be disclosed]

Policy for Constructive Dialogue with Shareholders

The Company holds constructive dialogue with shareholders with the aim of achieving sustainable growth and enhancing corporate value over the medium to long term. Through such dialogue, the Company shall clearly convey its management policy to shareholders and endeavor to gain their understanding, providing the Company’s management and the Board of Directors with feedback concerning the opinions and concerns of the shareholders obtained through dialogue, in the Company’s efforts to enhance corporate value.

- The Chief Executive Officer (CEO) of the Company shall assume the post of chair of the shareholders' meeting and pay careful attention as a supervisory manager to achieve constructive dialogue with shareholders in general, and the executive officer in charge of head of administrative division shall be responsible for all dialogue with shareholders. Each Director of the Board shall share the responsibility with consideration given to shareholders' requests, etc.

- The Shareholder Relations (SR) Department shall be established under the Executive Officer in charge of Head of Administrative Division to serve as the secretariat for holding dialogues between the Company and its shareholders. The SR Department shall exchange information regularly with the supervisor, Directors, the Finance & Accounting Division, and other related parties, who are engaged in constructive dialogues with shareholders. The SR Department shall also exchange opinions regarding disclosure and the explanation of financial results and other matters, based on expertise in their respective fields, and work in cooperation to hold the dialogue between the Company and its shareholders.

- The Company shall endeavor to obtain the shareholders' understanding of management strategy and the business environment through financial results briefings, the disclosure of information on the Company's website, and other means.

- The Board of Directors shall receive feedback concerning the dialogue between the Company and its shareholders in a timely and appropriate manner, and actively utilize them to formulate the Company's medium- and long-term business strategy, and other matters.

- The Company shall be well aware of the handling of insider information when holding dialogues with its shareholders, and shall thoroughly conduct the management and other treatment of insider information in accordance with the "Regulations for Timely Disclosure," "Administrative Regulations for Insider Information," and "Confidential Information Management Rules," prescribed separately. [Principle 5-1 Information to Be Disclosed]

(JVCKENWOOD Corporate Governance Policy, Article 4, Policy for Constructive Dialogue with Shareholders)

Status of dialogue between management and shareholders in FY2024

Policy on Strategic Shareholdings

The Company has set forth our policy on strategic shareholdings in the JVCKENWOOD Corporate Governance Policy.

- In the course of its business, the Company may hold shares in other companies whose business it expects to maintain and further expand. Such shareholdings include shares of companies held based on capital and business alliances concluded with the aim of achieving growth and developing the Company’s businesses, and shares held for the purpose of maintaining and strengthening business relationships. In the meantime, the Company shall verify the need for the Company to hold shares held based on past results every year by comprehensively examining the benefits, risks, capital costs and other factors associated with holding for each individual share and dispose of shares that the Company no longer needs to hold as much.

- Purchase and disposal of shareholdings will be carried out based on a resolution of the Board of Directors or the Board of Executive Officers upon establishing criteria based on importance by the Board of Directors.

- With respect to the exercise of voting rights concerning the shareholdings, the Company shall comprehensively determine, after reviewing proposals at the General Meeting of Shareholders, whether the contents of the proposals can enhance the corporate value of the companies in which the Company holds shares. The Company shall also assess such proposals in terms of their conformity with the reason for holding the shareholdings, and their impact on the Company. In addition, the Company shall confirm the companies whose shares it holds with regard to the intent of the proposals, whenever necessary. [Principle 1-4 Information to Be Disclosed]

- If any corporation or other entity which holds shares in the Company through strategic shareholding (a shareholder of strategic shareholdings) indicates its intention to sell or otherwise dispose of the shares it holds, the Company shall not present any condition that would be disadvantageous to the shareholder of strategic shareholdings, such as reducing transactions due to said sale, and deal with it, respecting the intention of the shareholder of strategic shareholdings to the maximum extent possible, while fully understanding the intention of the Corporate Governance Code and the intention of the shareholder of strategic shareholdings.

- Even in the case of entering into transactions with shareholders of strategic shareholdings, the Company shall do so after receiving a number of views and supervision from managers, etc. of other departments, in respect of individual transactions, in decision-making processes of the Board of Directors, etc. and also verifying the economic rationality in order to prevent any unreasonable transaction from occurring that will harm the interests of corporations or entities and common interests of shareholders due to a shareholding relationship.

Anti-Takeover Measures

If a share acquisition by a specific individual or group may risk damaging the corporate value or the common interests of shareholders, the Company considers it necessary to take appropriate measures to ensure the corporate value and the common interests of shareholders to the extent that can be tolerated by laws and regulations and the Articles of Incorporation. The Company also acknowledges the importance of ensuring the corporate value and the common interests of shareholders, and is carefully continuing reviews on the matter, but at this point no concrete defense measures have been implemented.