Font Size

CEO Message

Updated on 28 November, 2025

Achievement of Record Profits in Fiscal 2024

To enhance medium- to long-term corporate value in a rapidly changing business environment, the JVCKENWOOD Group is aiming to leap toward becoming an excellent company with strength and resilience based on our corporate philosophy of "Creating excitement and peace of mind for the people of the world."

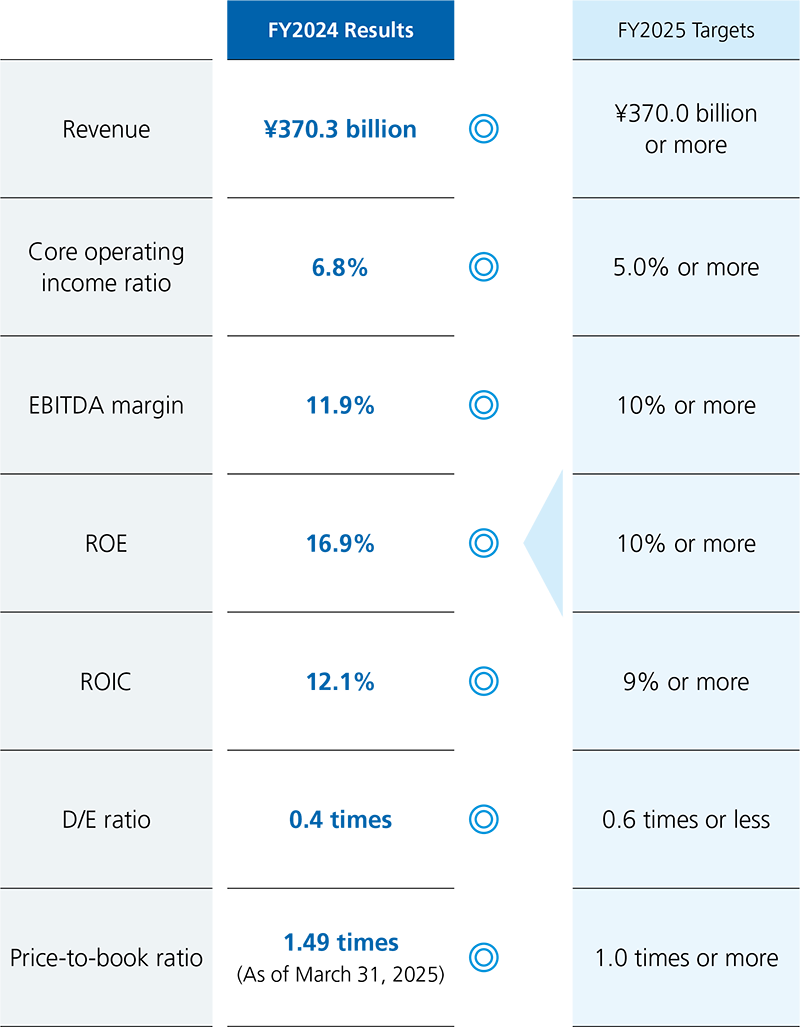

In fiscal 2024, the midpoint of the medium-term management plan VISION 2025, we mainly focused on implementing our business portfolio strategy and management that is aware of capital costs and share prices from among the measures we have been promoting to date. We also concentrated management resources on our growth sectors. As a result, we realized revenue increases in all three business sectors, broke the previous record for profits, and were able to achieve our major KPIs for the final year of VISION 2025 ahead of schedule. The main reasons for this were constant steady performance throughout the year for the Communications Systems Business in the Safety & Security Sector, which has been positioned as a growth-driving business and drives the growth of the Group, and strong progress for the Overseas OEM Business in the Mobility & Telematics Services Sector.

We have also received high praise for our sustainability management initiatives. We are steadily building up a foundation for growth from a long-term perspective, even in terms of non-financial indicators. Accordingly, we have been awarded 4.9 points, the highest of any Japanese corporation, in the United Kingdom's FTSE Russel's ESG Score (maximum five points).

Reflecting on Major KPIs in Fiscal 2024

History Can Change Overnight: The Trump Tariffs

Upon entering 2025, the world has seen more upheaval than ever.

Reciprocal tariffs introduced by the Trump administration are evidence that the U.S.-centric international system, which guaranteed economic freedom and safety in the 80 years since the end of World War II, has reached its limits, and they have caused immeasurable impacts on each region in which we operate. We must focus on how the global power balance will change going forward amid the Trump administration's rapid shift toward further protectionism.

Lenin is attributed to saying "there are decades where nothing happens, and then there are weeks where decades happen." I truly feel that the market environment and the turning points and currents of history can change overnight. Additionally, the Trump tariffs are also a type of paradigm shift, and I feel this is an opportunity to shift our approach from management that attempts to anticipate the future to management that assumes the future cannot be anticipated.

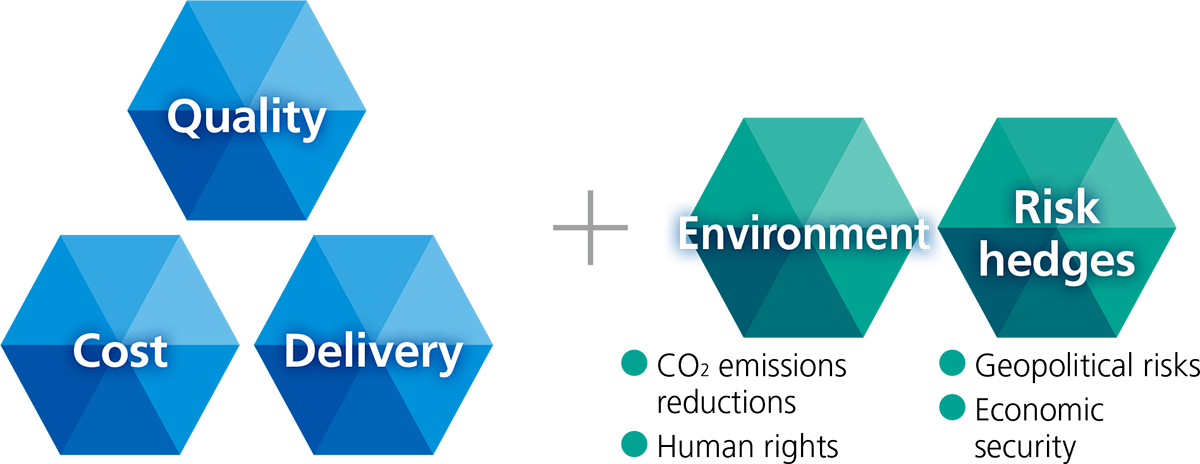

Amid an international climate where multiple crises are occurring simultaneously, corporate management must anticipate various risks and steer their Group organizations with a strong resolve to continue business no matter what happens. In particular, we are further strengthening awareness of the importance of optimizing product procurement and supply chains, not only from the perspective of our own circumstances but also from the perspective of megatrends, such as geopolitical risks and economic security guarantees.

Supply Chains That Consider the Environment and Geopolitical Risks

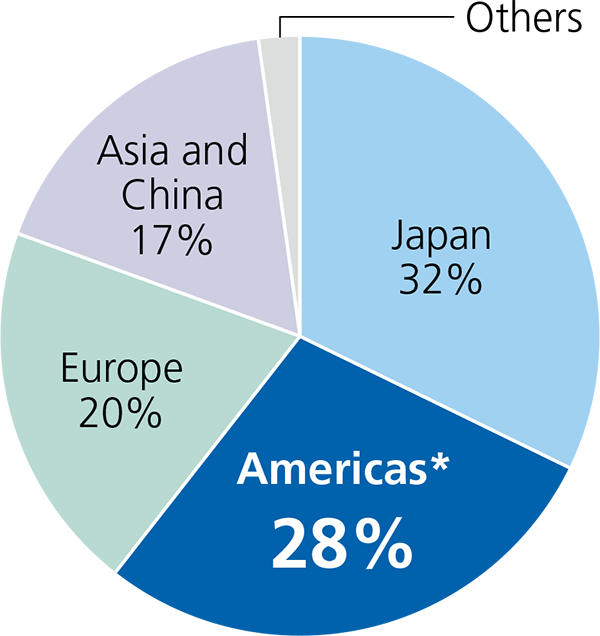

Currently, sales to the United States comprise approximately 25% of the Group's consolidated revenue. There is a high volume of sales to the United States in the Communications Systems Business, which is currently receiving particular attention, and the Aftermarket Business and the Media Business position the United States as the most important market. We have rapidly launched in- house projects to deal with the increased tariff rate and implemented price pass-on measures, production location changes, reviews of product lineups, and other initiatives at the same time as reviewing our procurement and supply chains at an early stage.

Sales Composition Ratio by Region

(FY2024: ¥370.3 billion)

* 25% accounted for by the United States

Following management integration, we have leveraged external pressure to reorganize our factory, R&D, and sales and marketing bases, achieving successful business reforms through our proven track record and experience. There is a significant difference in the performance of organizations that are highly capable of adapting to change and those that are not.

Environmental changes are a good opportunity to distinguish ourselves from rival companies and build up resilience to overcome change, further strengthening our corporate structure.

Corporate Value Management Focused on Capital Costs

Over the past few years, the Group has seen improved results and share prices, with the shareholder composition ratio also changing. We are reinforcing our investor and shareholder relations activities through dialogues with domestic and international investors and individual shareholders to ensure deeper understanding of the status of the Group's business. Through these dialogues, we will receive feedback on a wide range of issues and further refine the Group's initiatives, improving their evaluation. This will enable us to increase the number of people accompanying us on our future value creation journey.

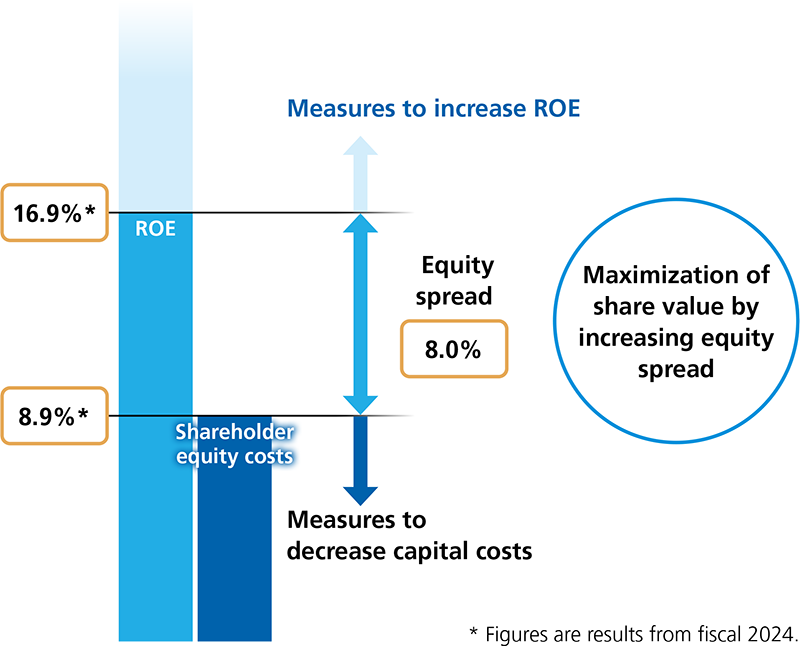

As the Group moves forward to promote full-scale capital cost management, it is important that we deepen communication by fully utilizing vocabulary, such as ROE and capital costs, that is shared with the capital market. Management with an awareness of capital costs, including what measures we should take to align market value and intrinsic value while being aware of our shareholders' and investors' perspectives, is a vital medium- to long-term growth strategy for the Group.

Corporate management is required to accurately understand the Group's capital costs and capital profitability so they can analyze and evaluate this information and the status of the market. They are also required to formulate policies, targets, and specific initiatives aimed at making improvements and to disclose in an easily digestible manner to shareholders and investors. The JVCKENWOOD Group, which previously had an insufficient approach to balance sheets and capital efficiency, is now promoting the enhancement of corporate value centered on capital costs, understanding of the current situation, and the establishment of a hurdle rate, as outlined below.

Corporate Value Management That Utilizes Capital Costs

| Understanding of Current Situation | Understand Group capital costs Determine if Groupwide ROIC exceeds capital costs Determine whether any businesses fall below capital costs |

|---|---|

| Development into Business Divisions | Expand Groupwide standard to business divisions Achieve targets for core operating income, ROIC, and free cash flow Utilize weighted average cost of capital and establish hurdle rates |

| Ideal Image | Establish medium- to long-term targets Achieve target share price and market capitalization Expand equity spread |

Thorough Implementation of the Concept of Capital Cost Management Within the Group

At the Groupwide management meeting held at PACIFICO Yokohama in May 2025, I shared our policy for enhancing corporate value going forward to approximately 700 managers. As part of this, I declared our approach to our business portfolio. From now on, we will prioritize increasing capital allocated to businesses that exceed capital costs (those that create value) and reducing the capital allocated to businesses that fall below capital costs (those that damage value). There was probably some confusion and surprise among numerous managers who have few contact points with the capital market on a daily basis.

However, JVCKENWOOD is listed on the Tokyo Stock Exchange Prime Market, so we must always engage with the capital market sincerely and head on. We are accelerating the shift of management resources to businesses in which ROIC is anticipated to grow significantly, such as the Communications Systems Business. Nevertheless, we must also take drastic measures with existing businesses that continue to operate below the hurdle rate and be unprofitable, depending on their condition, and consider their continuity. My mission is to guide the Group to greener pastures without losing sight of the big picture. For this reason, I am prepared to make integral decisions with a strong sense of responsibility. This management message strongly emphasizes that, to ensure our future survival and further strengthen our earning power, all Group employees must advance reforms without exception.

As constructive discussions are sought between companies and investors, we must also raise the quantity and quality of discussions between managers and employees, deepening understanding and creating a mutual sense of trust.

The truly important point of capital cost management is setting the direction of the Company and optimally allocating its resources, and we will engage in enhancing corporate value going forward.

Maximization of Equity Spread

Shift to a Board of Directors That Bridges Now and the Future

In fiscal 2025, the final year of VISION 2025, we transitioned to a company with audit and supervisory committee framework. Based on this new system, we must consolidate the results we have achieved to date and further increase the effectiveness of the Board of Directors and strengthen execution to achieve the leap forward required in the next stage: the new medium-term Management plan.

The word "governance" comes from the Latin phrase "gubernare," which means to steer the ship's rudder. Accordingly, I interpret this to be company management accurately and efficiently steering the Company without veering off course.

Meanwhile, within the field of corporate studies, corporate governance is still in its initial stage, and Japanese corporations are said to still be in the trial-and-error stage. I believe we must advance corporate governance going forward. "Advancement" refers to moving in a desirable direction based on the concept of progressivism. Constantly moving in an even better direction aligns well with a capitalist mindset.

Seventeen years have passed since the Group's business integration. It is vital that we continue to pursue even better corporate governance in line with the growth phase of the Group. Good governance provides support and must invigorate the entire business. JVCKENWOOD is just a single company. However, if a single company can improve the quality of its management, this not only benefits the company itself but also, depending on the circumstances, can lead to benefits for other companies and people. Just as innovation spurs further innovation, it is necessary that the entire industry, not only JVCKENWOOD, enhances the quality of its management by creating a positive ripple effect, thereby attracting investments to Japan from both domestic and overseas sources.

Executive officers are often overwhelmed by daily operations and are prone to short-term thinking. Within the Company, there is also a tendency to pull away from capital theories. To compensate for this, we expect external directors to fulfill their role of providing a wider perspective and future-oriented leadership. In other words, the Board of Directors is required to play a role in connecting the present with the future by enhancing the quality of deliberations through collaboration between the executive officers and supervisory bodies.

Deep Insights That Appeal to the Five Senses of Human Beings

We are currently witnessing a sudden digital revolution, represented by AI. As AI evolves at an accelerated pace, humans must increasingly focus on higher-value-added creative work. Now that we have entered an era of coexistence with AI, deepening our understanding of the realm of sensibility — including art and aesthetics — is essential to rediscover humanity's fundamental value.

Meanwhile, at JVCKENWOOD, we completed the construction of Value Creation Square (VCS) in the Yokohama headquarters area in October 2024. By integrating and concentrating business sites and sectors that had previously been decentralized, we are eliminating the culture of division and inward-looking mindsets and reorganizing the functions of each organization. The Hybrid Center is a four-story building adjacent to our headquarters with an atrium up to roof level that creates an open feeling without barriers and is filled with spaces for co-creation. By concentrating people and resources at VCS, we aim to deepen dialogues and exchanges between other sectors through face-to-face interactions that have been insufficient to date, share tacit knowledge, and pursue the true essence of manufacturing, technology, and design. Technology cannot exist independently without human involvement.

It is necessary to truly address people's fundamental needs by confirming customer and social needs to create the excitement and peace of mind that is part of our corporate philosophy. Namely, what matters most is honing your own sensibility and gaining deep insights that appeal to the five senses. Accordingly, I value the process and culture of fostering discussions where participants can share differing perspectives, objectively examine them, and then meticulously build solutions through the unrefined process of human relationships.

It has been said that "AI will reduce inefficiencies" and "humans are often inefficient and make mistakes." I want JVCKENWOOD to become a company that continues to learn and explore the future, driven by a strong sense of responsibility and enthusiasm for wanting to follow through no matter what and pioneering a new era with our own hands.

Mind the Gap! — Visualization of Invisible Value

Despite breaking our record for profits in fiscal 2024, we cannot be satisfied with stopping there. I believe that we can do more and are only just beginning. The Group should acquire numerous tangible and intangible latent advantages.

On the London Underground, you can often hear "Mind the gap!" over the loudspeakers. "Gap" can refer to a physical distance, but also a deviation between reality and the ideal. While there is always a gap between reality and what is ideal, the higher the ideal is, the more it reveals what is lacking and what we must overcome. It is because there is a gap that we can push forward to achieve our ideal image. This is what sparks our motivation.

Upon hearing "mind the gap!" I ask myself questions in my mind.

How can we bridge such gaps such as distance from intrinsic value, the discrepancy with investors' perspectives, the deviation from our ideal image and vision for the Company, the connection between manufacturing and value creation, and the visualization of invisible value? While I understand that the road ahead will not be smooth, we will nevertheless adopt ambitious goals and pursue them with a strong sense of determination. I believe such outstanding requirements are the source of growth for employees and the Company.

While still in the midst of its growth and development, JVCKENWOOD will strive to build an unshakable management foundation by looking beyond our immediate steps and toward the horizon. This will enable us to become an even stronger company in five or ten years, evolving into an even more attractive enterprise.

Support / Others