Font Size

CFO Message

Updated on 28 November, 2025

Current Value Creation Status, Issues, and Direction

Under the medium-term management plan VISION 2025, we aim to further strengthen our business foundation by improving performance in order to manage our stock price more consciously, improve capital efficiency by enhancing shareholder returns and implementing financial and equity strategies, and promote sustainability management to maximize corporate value and set a basic strategy to achieve a price-to-book (P/B) ratio of more than 1.0 at the earliest possible date.

In fiscal 2024, the second year of the plan, we achieved revenue of ¥370.3 billion, core operating income of ¥25.3 billion (core operating income ratio of 6.8%), return on equity (ROE) of 16.9%, return on invested capital (ROIC) of 12.1%, and a ratio of equity attributable to owners of the parent to total assets of 39.9%, significantly exceeding the earnings forecast upwardly revised in October 2024. We successfully achieved the majority of the numerical targets for fiscal 2025, the final year of VISION 2025.

In addition, the Company has been proactive in paying out dividends and returning value to shareholders. As a result, its P/B ratio is expected to remain above 1.0.

Under VISION 2025, which has been making good progress, we aim to further increase our P/B ratio to promote further growth in growth-driving businesses by carrying out investments, including M&As, and accelerating structural reforms in the restructuring business.

Management That is Conscious of Capital Cost and Stock Price

In VISION 2025, we have set targets for fiscal 2025, the final year of the plan, of ROE of 10% or more, a debt-to-equity (D/E) ratio of 0.6 or less, and a ratio of equity attributable to owners of the parent to total assets of 35% or more. We are further promoting the improvements to our business structure that we have been working on under the previous medium-term management plan VISION 2023. Furthermore, in order to realize management that is conscious of capital costs and stock price, we are implementing more proactive shareholder return measures and improving capital efficiency by adding ROIC as a new financial indicator.

In fiscal 2024, each division will understand where it stands against the hurdle rate and consider what needs to be done to improve ROIC. Based on that, the CEO and CFO will then evaluate the business portfolio.

During the evaluation process, we aimed to instill ROIC management by ensuring each business manager understands the working capital and amount of non-current assets held by their division and can explain the current status of ROIC to their division and how to make improvements in the future. We will also promote such activities going forward to improve our capital efficiency.

Trends in Key Management Indicators

| FY2022 (Results) |

FY2023 (Results) |

FY2024 (Results) |

FY2025 (Targets) |

|

|---|---|---|---|---|

| Revenue | ¥336.9 billion | ¥359.5 billion | ¥370.3 billion | ¥370.0 billion or more |

| Core operating income ratio | 4.7% | 5.5% | 6.8% | 5.0% or more |

| Ratio of equity attributable to owners of the parent to total assets | 33.0% | 36.2% | 39.9% | 35% or more |

| EBITDA | ¥42.3 billion | ¥40.6 billion | ¥44.0 billion | - |

| EBITDA margin | 12.5% | 11.3% | 11.9% | 10% or more |

| ROE | 18.2% | 12.2% | 16.9% | 10% or more |

| ROA | 5.6% | 4.2% | 6.4% | - |

| ROIC | 8.3% | 8.9% | 12.1% | 9% or more |

Capital Allocation Policy

Under VISION 2025, we continue to focus on generating cash flows and ensure an effective outflow of cash after making the use of funds clear.

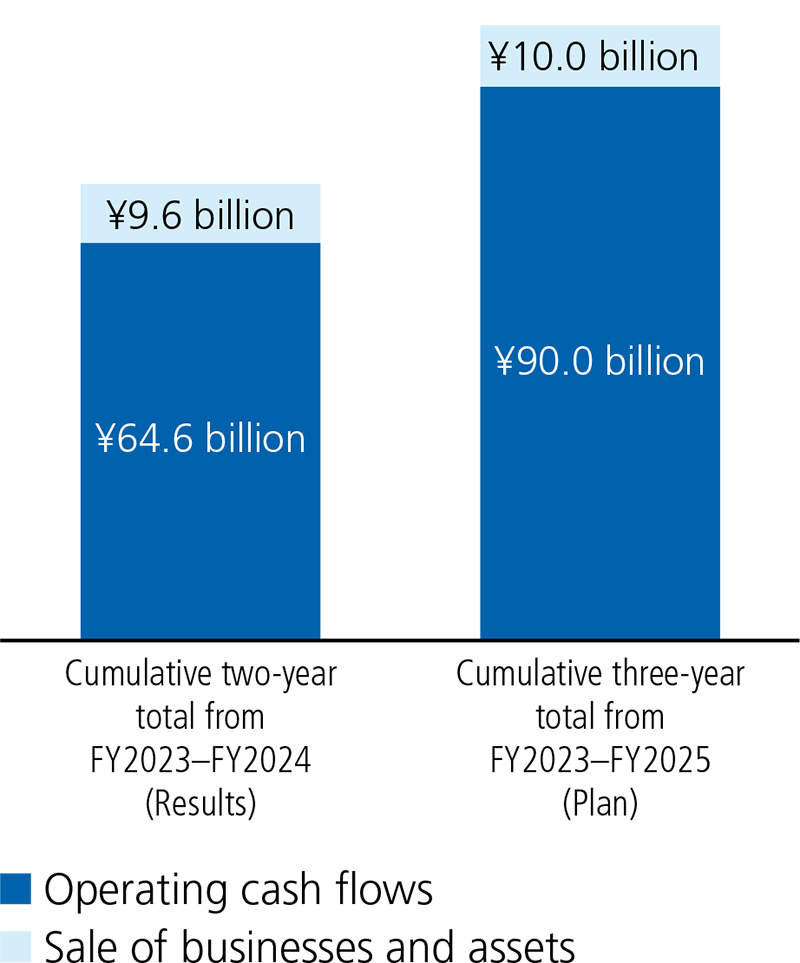

Inflows of cash over the three years of the plan are expected to be ¥100.0 billion, including cash of about ¥10.0 billion resulting from the sale of businesses and assets, in addition to about ¥90.0 billion in operating cash flows. The results for fiscal 2023 and 2024 have exceeded expectations, with operating cash flows of ¥64.6 billion and income from the sale of businesses and assets of ¥9.6 billion.

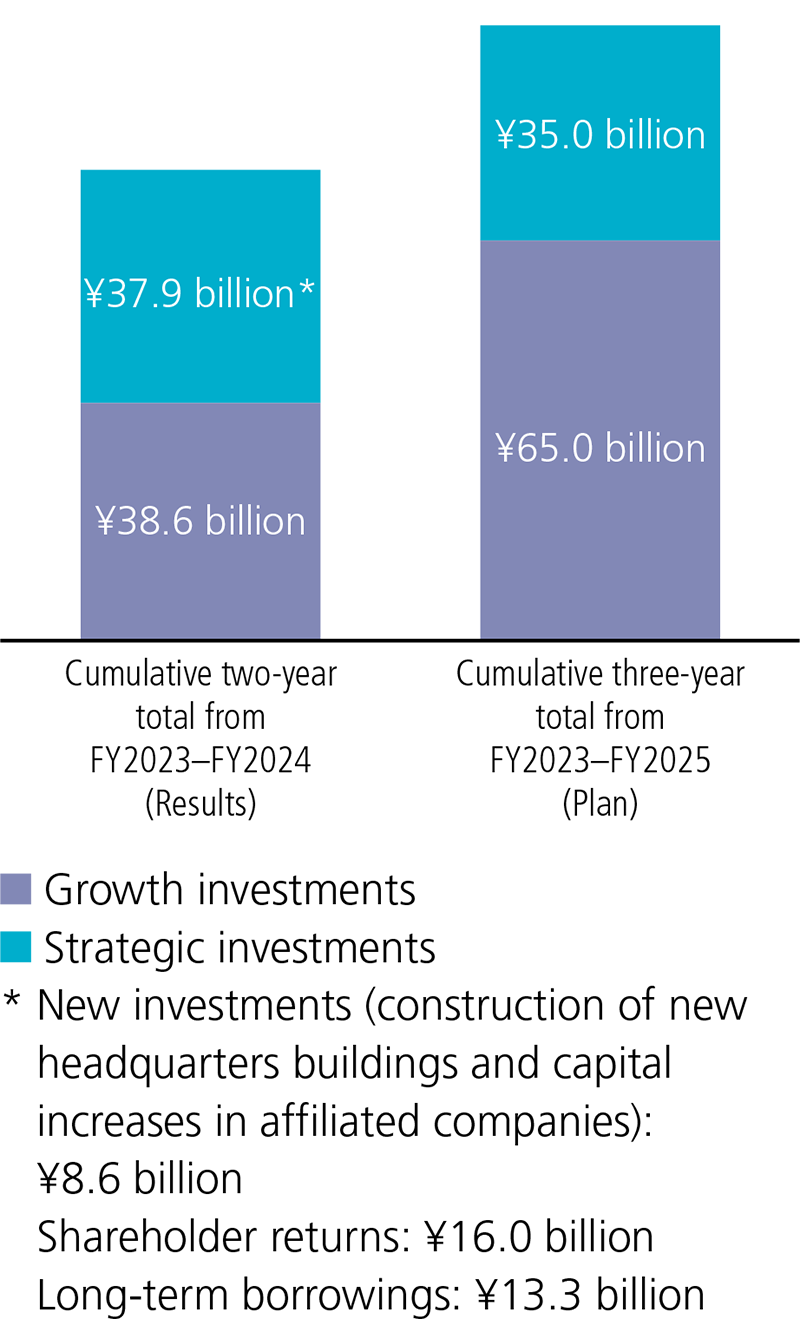

In terms of cash outflows over the three years of the plan, we planned to use approximately ¥65.0 billion for growth investments to expand and maintain our existing businesses and approximately ¥35.0 billion for strategic investments. The actual results for fiscal 2023 and 2024 are ¥38.6 billion for growth investments; ¥8.6 billion for strategic investments, such as new investments for the construction of new headquarters buildings and capital increases in affiliated companies; ¥16.0 billion for shareholder returns; and ¥13.3 billion for long-term borrowings.

Going forward, in addition to shareholder returns, we plan to carry out the investments necessary for growth, such as M&As focused on growth-driving businesses.

Cash Inflows

Cash Outflows

To Our Shareholders and Investors

In formulating VISION 2025, we changed our shareholder return policy based on the expectations of shareholders and investors, as well as the Company's business environment and status of equity.

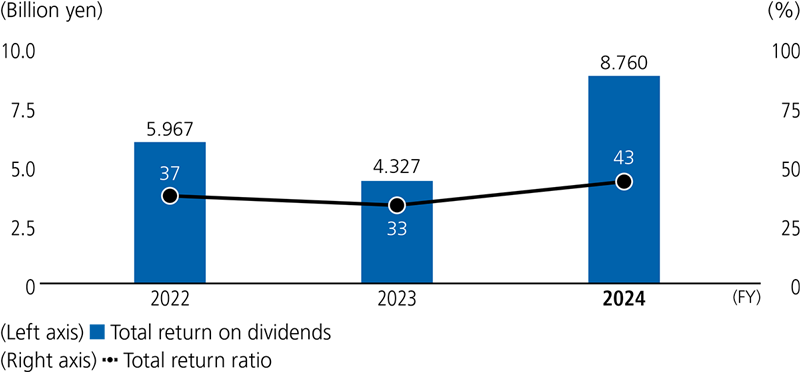

Under the new shareholder return policy, we will flexibly acquire treasury shares while balancing the utilization of equity for medium- to long-term profit growth and the effect of improvement of capital efficiency, in addition to the existing dividends. In doing so, we are changing the guidelines for shareholder returns from the conventional dividend payout ratio to the total return ratio and set the target for the total return ratio at 30% to 40% to enhance shareholder returns more than ever. For the time being, we plan to allocate approximately 40% of the total return to dividends and approximately 60% to acquisition of treasury shares.

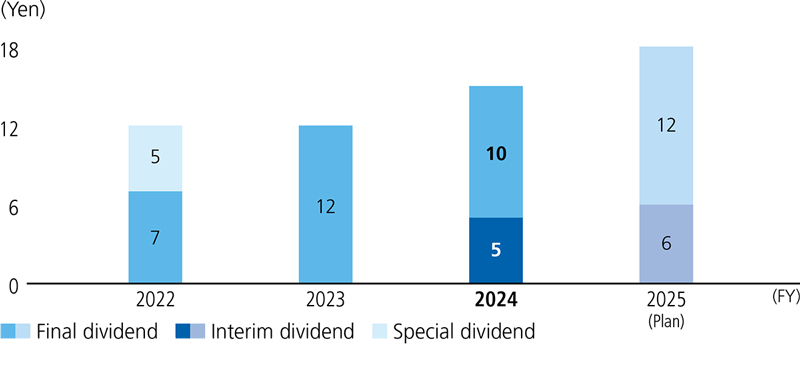

Based on this concept, the dividend for fiscal 2024 was ¥15 in total, including ¥5 of the interim dividend and ¥10 of the final dividend, which is a year-on-year increase of ¥3. Additionally, we acquired treasury shares of ¥4.5 billion during the period between November 6, 2024 and February 4, 2025 and ¥2.0 billion in the period between May 8, 2025 and June 5, 2025. As a result, the total return ratio for fiscal 2024 was approximately 43%.

In fiscal 2024, this resulted in shareholder returns that exceeded the targeted total return ratio of 30% to 40%. This was a result of the decision to make a sudden acquisition of treasury shares of ¥2.0 billion in April 2025, which marked our lowest stock price of the year, due to the impact of the announcement of reciprocal tariffs by the United States. Going forward, we aim to maximize shareholder value by flexibly acquiring treasury shares while observing stock price trends.

Further, we expect total dividends to rise by ¥3 to ¥18, ¥6 of which accounts for the interim dividend.

Changes in Dividends

Trends in Total Return on Dividends and Total Return Ratio

Support / Others