Responses to Climate Change

Basic Policy

Climate change is a key management issue, and the JVCKENWOOD Group will work to avoid or reduce the impact of climate change on the Group throughout its entire value chain, including procurement, product development, manufacturing, and product and service provision.

To this end, initiatives to contribute to the mitigation of and adaptation to climate change are important. The JVCKENWOOD Group will endeavor to reduce CO₂ emissions in the Scope 1+2 and Scope 3 categories and to reduce energy use through reduction of production man-hours and installation of energy-saving equipment.

The JVC Kenwood Group has set a short-term mid- to long-term global carbon reduction target as follows.

■Reduction of CO₂ emissions generated from business activities

Responses to climate change: Achieve carbon neutrality by 2050

Scopes 1 + 2 Target:46.2% reduction from FY2019 levels by FY2030 (total, global)

In promoting our initiatives, we set the following KPI (Key Performance Indicators) and manage their progress.

| Theme | Plan/Achievement | KPI | |||

|---|---|---|---|---|---|

| FY2023 | FY2024 | FY2025 | FY2030 | ||

| Reduction of CO2 emissions (Scope 1 + 2) (compared to FY2019) | Plan | -16.8% | -21.0% | -25.2% | -46.2% |

| Achievement | -41.0% | ||||

■Reduction of CO₂ emissions through the use of purchased, transported, and sold products

Scope 3 target: 13.5% reduction from FY2019 levels by FY2030 (Categories 1, 4, 11*, global)

In promoting our initiatives, we set the following KPI (Key Performance Indicators) and manage their progress.

| Theme | Plan/Achievement | KPI | |||

|---|---|---|---|---|---|

| FY2023 | FY2024 | FY2025 | FY2030 | ||

| Reduction of CO2 emissions (Scope 3) (Categories 1, 4, 11) (compared to FY2019) | Plan | -3.68% | -6.15% | -7.38% | -13.5% |

| Achievement | -11.2% | ||||

As part of our initiatives aimed at achieving this target, we have been monitoring power consumption at business centers, upgrading production/air-conditioning equipment to high-efficiency models, introducing LED lighting, and promoting environmental education among employees. As a member of the Japan Electronics and Information Technology Industries Association (JEITA), we have been collaborating and gathering information on not only reducing total CO₂ emissions but also improv energy intensity. In 2019 we participated in the Ministry of the Environment’s program designed to support companies that use internal carbon pricing and started efforts to raise in-house awareness about the environmental cost of carbon (for details, see the website of the Ministry of the Environment ). Going forward, with the aim of participating in the "GX League*" sponsored by the Ministry of Economy, Trade and Industry. we will consider emissions trading, formation of market rules, creation of business opportunities, and exchanges with participating companies to achieve emissions reductions and increase industrial competitiveness.

*GX League: A league of companies with leadership in providing value for social structural change towards carbon neutrality, including voluntary greenhouse gas emission trading (GX-ETS).

At the JVCKENWOOD Group, we are gathering relevant information, including science-based targets (SBT), and engaging in in-depth discussions on setting targets under the leadership of the Sustainability Management Office. We will continue to implement measures whenever we can to ensure the appropriate setting and management of targets as well as disclosure of information.

Disclosure Based on TCFD Recommendations

In April 2023, the Group expressed its endorsement of the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) established by the Financial Stability Board (FSB).

For details, see the website of Task Force on Climate-related Financial Disclosures

■Governance

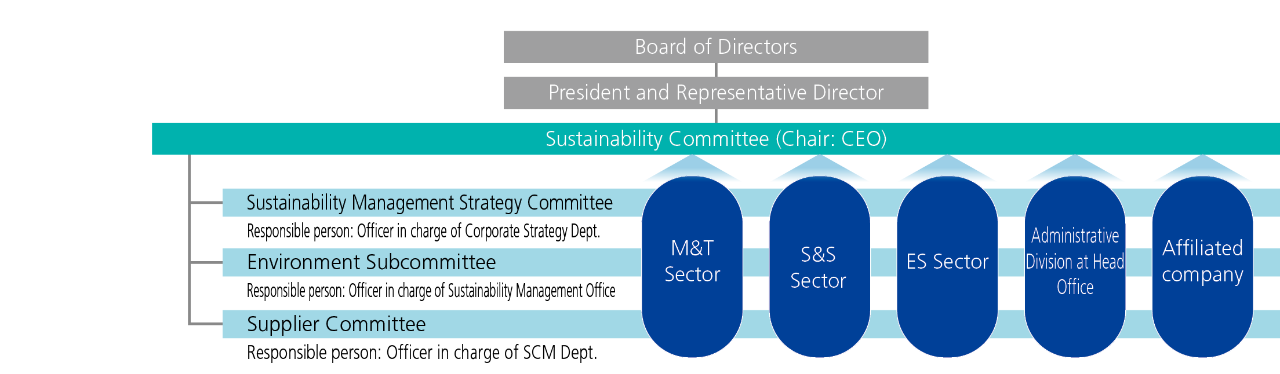

The JVCKENWOOD Group recognizes that addressing climate change is one of the important issues in its sustainability promotion strategy. The Company appointed a director in charge of sustainability under the supervision of the Board of Directors, and established the Sustainability Management Office in April 2018 to establish a system for quickly implementing sustainability promotion strategies including those related to climate change.

The Sustainability Management Office is responsible for coordinating the implementation of company-wide climate change initiatives and progress management. It works with relevant divisions to periodically review material issues and key performance indicators (KPI), study and collect information about the potential effects of climate change on our operations, and enhance the disclosure of sustainability-related information.

In addition, the Sustainability Management Office actively communicates with relevant departments and sections and takes the lead in efforts to make sustainability part of our business operations, all with an eye to fostering awareness and understanding of climate change issues within the Group.

In addition, as a governance structure to address climate change, the Sustainability Committee was established that reports directly to the CEO in FY2023 as the primary organization to promote overall sustainability, including addressing climate change. It will formulate strategies and study measures for decarbonization. Augmenting regular meetings twice a year, the Committee holds ad hoc meetings as necessary, and reports its discussions to the Executive Committee and the Board of Directors. In addition, as a sub-organization of the Sustainability Committee, we have established a specialized subcommittee with the executive officer in charge of each theme (the Environment Subcommittee on climate change) to discuss and promote the identification of issues, goals, implementation plans, and specific responses for each theme. The Board of Directors monitors and oversees these committees and meetings and makes decisions.

Sustainability Promotion Structure

As specific activities for FY2023, the Environmental Subcommittee discussed the setting of targets under "JK Green 2030," which mainly focuses on " response to climate change," "effective use of resources," "environmental conservation and management," and " conservation of biodiversity," and these were approved by a resolution of the Board of Directors. In addition, as activities of the Supplier Subcommittee, efforts are being made to improve the accuracy of calculation and reduce emissions, especially for Category 1: emissions associated with raw materials, parts, and purchased , and Category 4: emissions associated with transportation of raw materials and products under Scope 3.

■Strategies

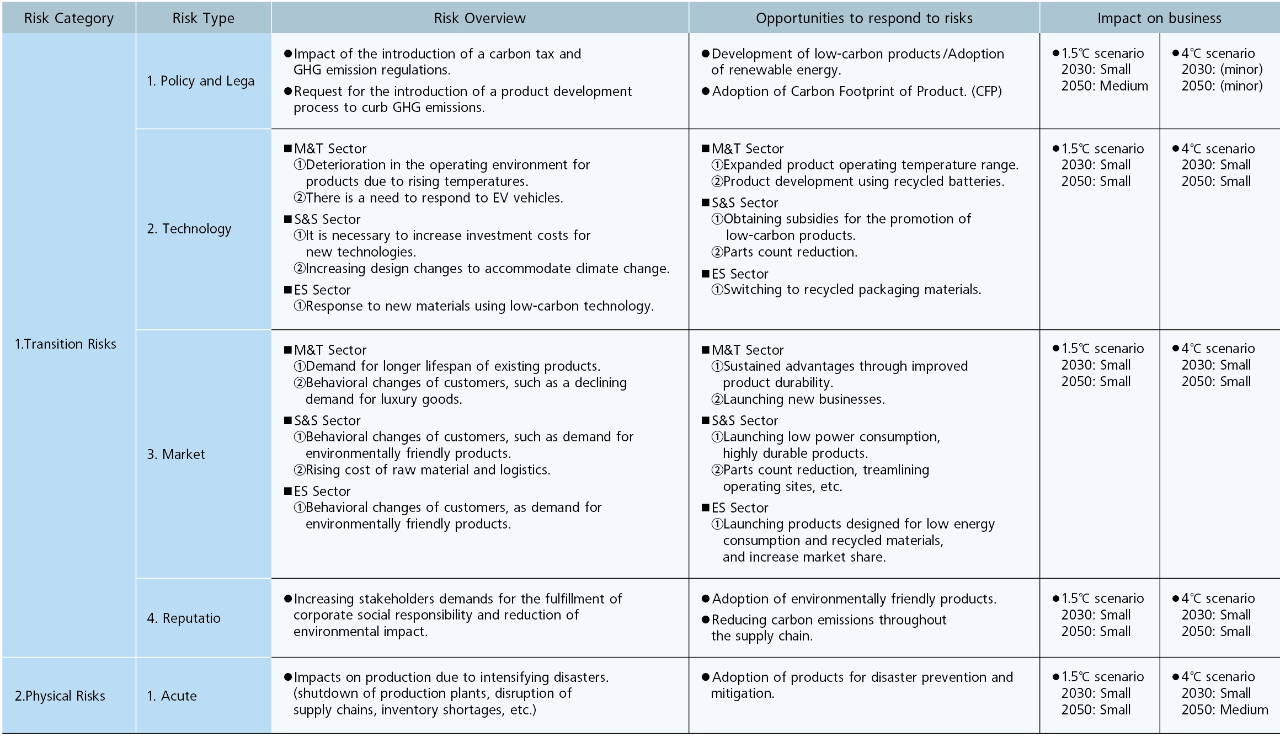

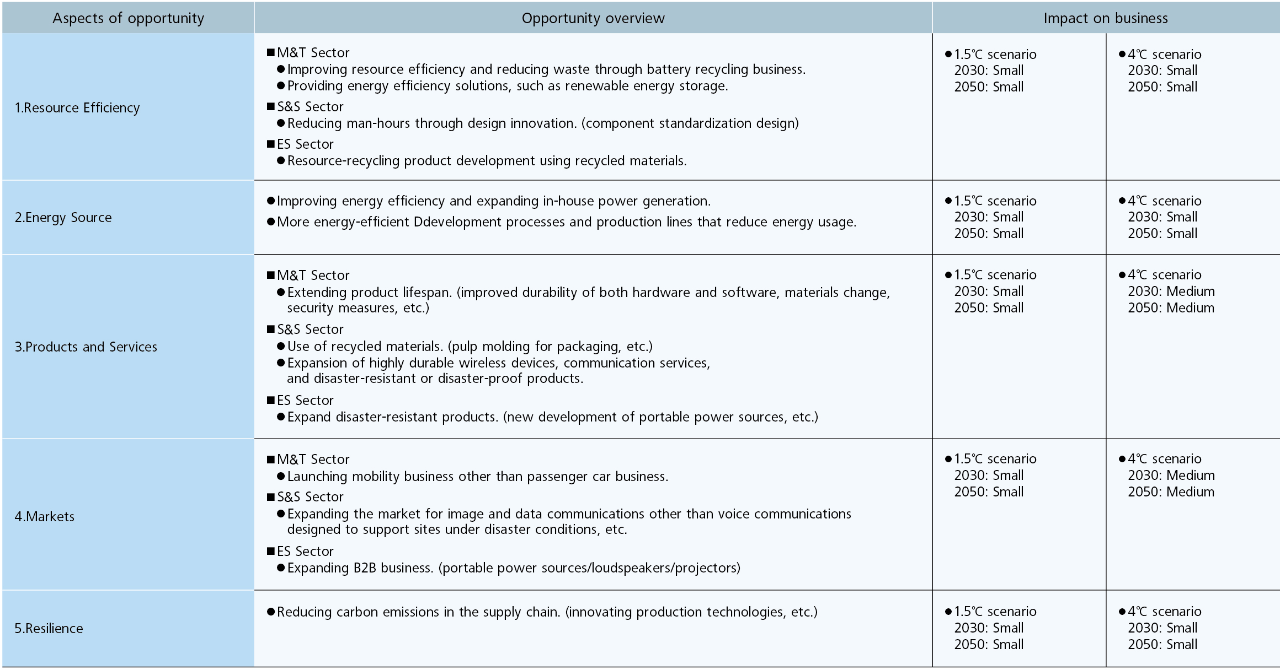

JVCKENWOOD Group conducted a scenario analysis in accordance with the TCFD recommendations to identify risks and opportunities, and to analyze and examine the impact level and countermeasures.

Identification of risks and opportunities in the JVCKENWOOD Group and impact on the business

As a countermeasure to the risks and opportunities identified, we will develop and introduce environmentally friendly products and products for disaster prevention and mitigation, and work to develop new markets. In addition, in conjunction with the new mid-term management plan “VISION2025”, we will return to domestic production in products for the Japanese domestic market, optimize the layout of production bases in consideration of total production volume, develop products with reduced environmental impact, study alternatives to natural resource facilities, and plan investments in measures such as the use of renewable energy power. We will respond to various risks by reducing energy consumption and emissions, improving the efficiency of processes in manufacturing, transportation, and other corporate activities through such measures as the following.

■Risk Management

We implement the risk surveillance process at all its business sites around the world every year. The purpose is to ensure the risk management activities are conducted through collaboration between its business sites and management. As the risk items for the risk surveillance process include natural disasters, we also identify, assess and manage climate change risks. For details of the risk surveillance process, see Enterprise Risk Management.

In terms of risk surveillance, we have added risk management (transition and physical risks and their classification items) in line with TCFD recommendations among the risk categories to be considered. This allows us to clearly manage the risks stemming from climate change, while also managing the progress of our response measures in a holistic manner in tandem with other general risks.

| Risk categories | Events | ||

|---|---|---|---|

| Categories | subcategories | Further subcategories | |

| Climate risks | Transition risks | Policy and legal | Introduction of carbon taxes |

| Regulations for Greenhouse Gas Emissions / Duty of Greenhouse Gas Emissions reporting | |||

| Cost increase by an energy saving measures and the capital investment | |||

| Tighter regulation | |||

| Market | Cost increase of raw materials, the energy | ||

| Changing consumer behavior | |||

| Changes in priority products/product pricing | |||

| Technology | Delay in renewable energy and energy saving technology development | ||

| Increase in R&D investment for environmentally friendly products | |||

| Reputation | Changes in consumer opinion | ||

| Changes in investor opinion | |||

| Brand damage | |||

| Physical risks | Acute | Intensifying extreme weather patterns(typhoon/Flood) | |

| Cost increase by the BCP correspondence | |||

| Chronic | Increase in average temperature | ||

| Floods | |||

| Rising sea levels | |||

■KPI and Targets

The JVCKENWOOD Group has formulated and is promoting JK Green 2030. To address the risks of climate change, our short- to medium-term goals for Scope 1+2 are to reduce emissions by 46.2% from 2019 levels by 2030 and by 13.5% for Scope 3 over the same time span. We have set a long-term goal of achieving carbon neutrality by 2050.

For more information, see the website of Reduction of CO2 emissions

Collaboration with External Organizations

As a member of the Japan Climate Initiative (JCI), the JVCKENWOOD Group exchanges information and supports policy recommendations related to climate change. JCI is a network of companies, local governments, NGOs, and other organizations that have joined forces with the rest of the world to be at the forefront of the challenge to achieve the decarbonization goals set out by the Paris Agreement. JCI lobbies for governmental strategies to reduce greenhouse gas emissions and expresses its views at international conferences on climate change. Having endorsed JCI's declaration, "Joining the front line of the global push for decarbonization from Japan," the JVCKENWOOD Group engages in dialogue with policymakers through participation in climate change initiatives. The JVCKENWOOD Group will continue stepping up its efforts, including reducing energy consumption in the production process in line with the statement, "Accelerating energy efficiency and the use of renewable energy in our own activities to demonstrate the global leadership in achieving the 1.5°C goal."

The JVCKENWOOD Group is a member of the Association for Electric Home Appliances (AEHA) . The AEHA is an organization that conducts research/studies and develops and implements relevant policies based on a comprehensive understanding of problems common to household appliances. With household energy consumption on the rise in Japan, we inform consumers that energy saving and the use of energy-saving household appliances are effective for global warming and promote relevant countermeasures. In support of the AEHA’s policy, we participate in the Board of Directors’ meeting and the Environment Officers’ meeting as a supporting member. We also participate in the meetings of relevant committees, such as the “Energy Saving Committee,” the “Home Appliance Recycling Committee” and the “Containers and Packaging Recycling Committee” to provide proposals and exchange opinions. If it is determined that any policies differ between the AEHA and the Group as a result of the exchange of opinions, the policies will be reconsidered and we will appropriately respond.

In addition, the JVCKENWOOD Group is a member of the Japan Machinery Center for Trade and Investment (JMC), and participates as a member of the JMC's Global Environmental Measures Committee and Environmental Policy Trends Specialist Committee, where it exchanges information on environmental issues related to climate change, such as carbon neutrality, and future regulatory policy trends in major countries and regions, particularly the EU. The committee also exchanges information on each company's initiatives, invites experts on environmental issues from governments and related organizations to give lectures and exchange opinions on climate change-related issues such as carbon neutrality, and on policy trends related to future regulations in major countries and regions, particularly the EU.

*Category 1: Emissions associated with raw materials, parts, and purchased products; Category 4: Emissions associated with transportation of raw materials and products; Category 11: Emissions associated with assumed electric power consumption for the use of products sold